- Home

- Web3 & Blockchain

- RWA Real Estate 2 up

Raise Capital in Days with Real Estate Tokenization

We develop custom tokenization platforms that let you tokenize assets, access global investors, and close deals faster

Book a call and learn how tokenization can enhance your capital growth.

Alex Topal

Chief Technology Officer

Why tokenization is the key to efficiency

Attract Global Investors from $50

Open your property to a worldwide investor base with a low entry point — sometimes starting from as little as $50 — dramatically expanding your capital pool.

Split Property into 10,000 Tokens

We create a customized number of tokens — often 10,000+ — each a verified ownership share offering instant liquidity.

Sell Directly, Online

Investors onboard, pass KYC/AML and buy directly through your branded portal — no offline frictions.

Fewer Intermediaries

Fewer brokers and admins — KYC, commitments and payouts run digitally in one system.

Liquidity 24/7

The platforms we develop enable tokenized real estate to trade 24/7 on approved markets, turning illiquid assets into liquid ones.

Investors enjoy easier exits and higher valuations as liquid assets command better prices, while tokens can be resold anytime on secondary markets for added flexibility and stronger appeal.

Raise Capital in Days, Not Months

A tokenization platform uses smart contracts and a single investor portal to automate onboarding, payments, and reporting — cutting costs and paperwork. In some market cases, offerings closed in as little as 48 hours

Worldwide investors can fund your property instantly, without banks or delays.

Up to 70% Cost Savings

Platforms we develop boost efficiency by digitalizing investor onboarding, management, and income distribution:

- You can cut administrative costs by up to 50–70%;

- Smart contracts handle distributions and cap tables automatically, eliminating expensive intermediaries;

- All stakeholders see a transparent transaction history on the blockchain, building confidence and reducing disputes.

Discover How Real-Estate Tokenization Works

Inside this free guide you’ll find:

- The benefits and opportunities of real estate tokenization

- Solutions to key challenges in the real estate business

- A step-by-step plan

We develop solutions for

Real Estate Developers

Turn properties into digital shares to raise funds fast, keep ownership, and create early liquidity for your developments.

Investment Funds

Boost portfolio agility with tokenized real estate — unlock partial exits, secondary trading, and new investor segments.

PropTech Platforms

Add instant, regulated property-investment tools via white-label tokenization to grow user retention and revenue.

Financial Institutions

Offer clients compliant real-estate tokens under your brand, adding fee income and a modern digital-asset product.

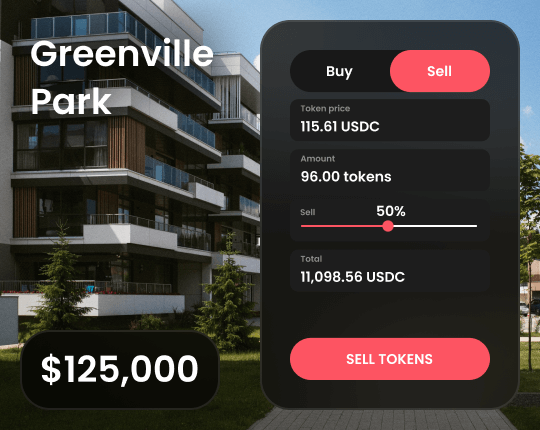

PROVEN BUSINESS MODELS WE CAN BUILD

These real estate platforms are already attracting millions in investments, proving that digital ownership works — and we can build a similar solution tailored to your business.

Landshare: Tokenized House-Flipping Platform

Invest From $50

Enables fractional investments in real estate renovation projects, with minimum investments starting at $50

Funded In 48 Hours

Projects have achieved funding goals in as little as 48 hours, showcasing rapid capital mobilization.

Profit On Property Sales

Offers investors the opportunity to earn returns from property renovations and subsequent sales.

Transparent Financial Tracking

Provides an on-chain valuation system, offering transparent financial data for each property, including values, cash flows, and expenses

RealT: Fractional Ownership of Rental Properties

535+ Tokenized Properties

Provides access to more than 535 blockchain-based rental properties.

Active Token Marketplace

Offers a platform for buying and selling property tokens.

Global Entry from $50

Facilitates global investment opportunities in U.S. real estate, with tokens priced as low as $50.

Investors From 154 Countries

Serves a diverse investor base from 154 countries, enabling ownership of U.S. rental properties through a user-friendly platform.

Redswan: Commercial Real Estate Tokenization Platform

$2.2B Tokenized Assets

Over $2.2 billion in Class A commercial properties across major U.S. cities (Brooklyn, Austin, Houston, and Ontario).

Fully Compliant Investments

Operates as a SEC-registered investment adviser and FINRA/SIPC-member broker-dealer, ensuring compliance and transparency for investors.

Access to 33% IRR–Targeting Funds

Provides investment access to institutional funds like Altus (~33% IRR) and GCC (35 debt-free assets), with minimums from $25K–$500K.

Access to Premium Real Estate

Provides mid-sized investors entry to high-end commercial properties, a market once reserved for large institutions.

Compliance Without Headaches

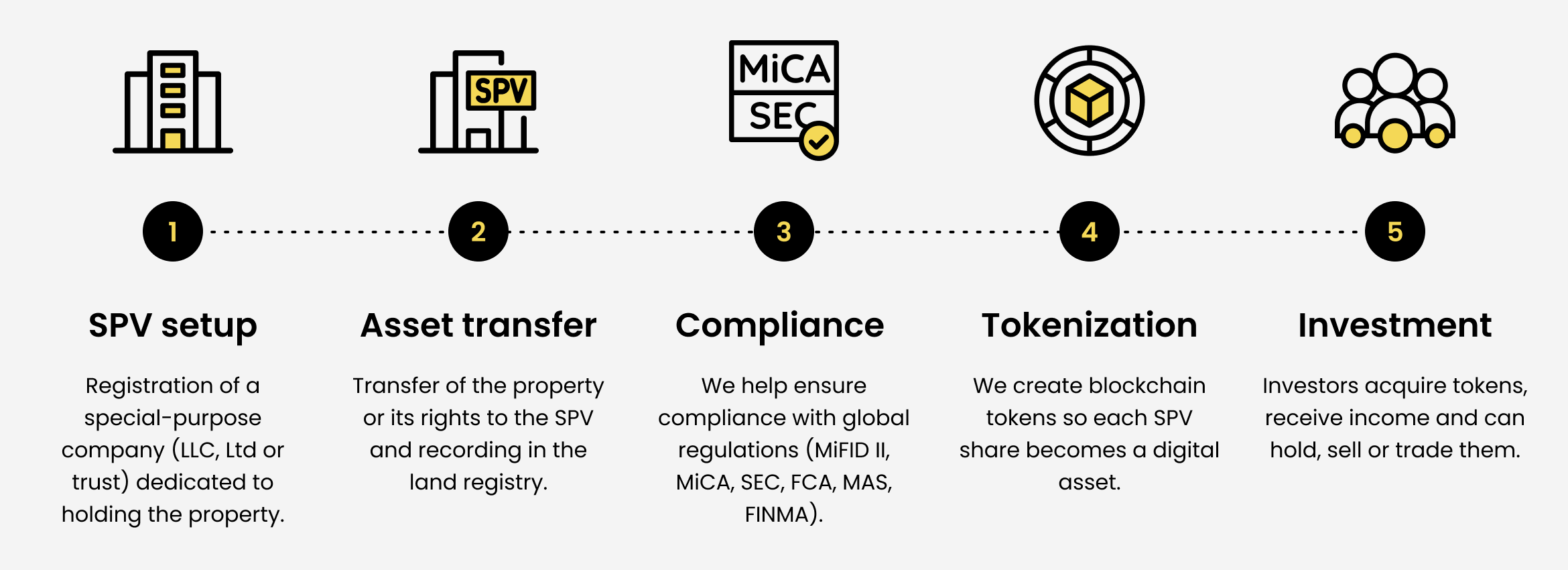

We cover

1

SPV Setup

Support with structuring and registration of compliant SPVs in investor-friendly jurisdictions (e.g., Luxembourg, UK, UAE, offshore).

2

Global Compliance

Consulting and legal coordination to align with MiCA, ESMA, FCA, and other international standards.

3

STO Legal Structuring

Preparation of full legal documentation for Security Token Offerings (STO), including investor terms and disclosures.

4

Investor Onboarding

Integration and setup of KYC/AML verification processes for smooth investor onboarding.

Worried about securities rules or jurisdiction choice? Discuss it with our legal experts.

How to get started in 4 easy steps

Project Assessment & Strategy

Project Assessment & Strategy

We begin with a detailed review of your real estate project and funding objectives.

Cyberbee helps define the optimal tokenization model (equity, revenue-share, debt), investor type, and jurisdiction—ensuring full legal and technical alignment.

You receive a clear tokenization roadmap tailored to your business goals.

Legal Framework & Token Architecture

Legal Framework & Token Architecture

We set up a compliant legal structure—typically a Special Purpose Vehicle (SPV)—and handle the preparation of offering documents, shareholder agreements, and regulatory filings.

Simultaneously, we generate your security tokens on a blockchain like Ethereum or Polygon, embedding investor rights (dividends, governance, etc.). Tokens are legally tied to real assets and ready for compliant distribution.

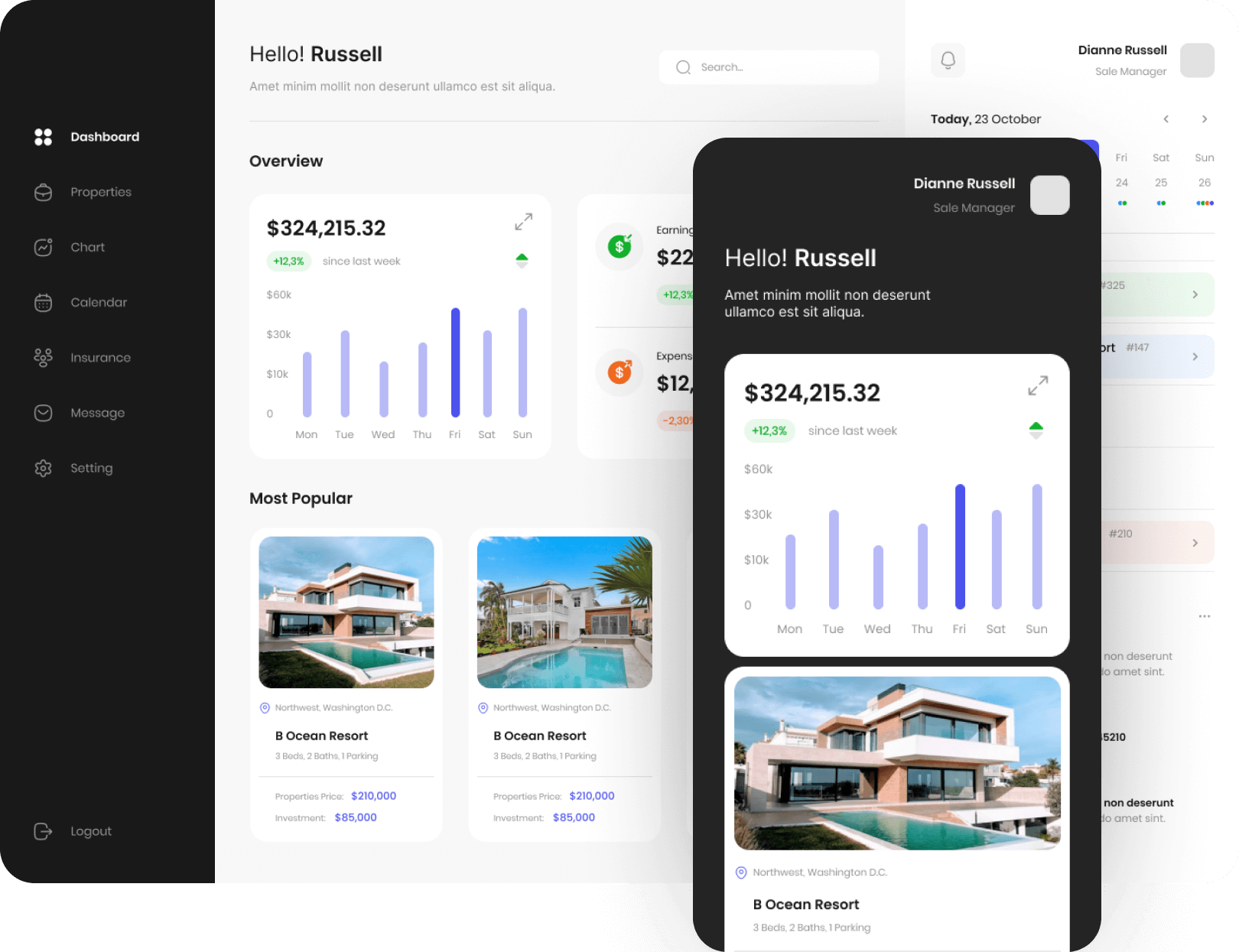

Product Development & STO Launch

Product Development & STO Launch

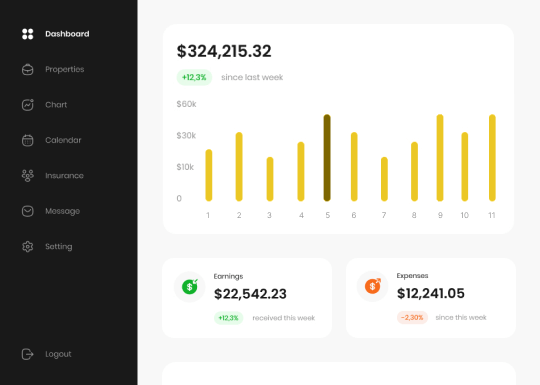

Cyberbee builds your custom-branded investment platform, including:

- Investor dashboard with real-time data & portfolio tracking

- KYC/AML onboarding modules

- Payment integrations (fiat, crypto, stablecoins)

- Admin panel for cap table, payouts & reporting

Once the platform is ready, you launch your private or public Security Token Offering (STO). Investors register, pass verification, and purchase tokens directly through the interface.

The entire fundraising process is online and efficient, often completing in weeks instead of months

Post-STO Management & Liquidity

Post-STO Management & Liquidity

After fundraising, investors can hold or trade tokens on approved secondary markets. The platform enables ongoing investor communication, automated dividend distribution, document management, and regulatory reporting.

If secondary market access is needed, we assist with listing on licensed ATS or exchange partners.

Ready to Tokenize Your Real Estate?

Fill out the application form and we'll show you how it works!