What are Crypto Loans

In today’s fast paced financial world traditional lending options can be restrictive and slow. For individuals and businesses looking for a more flexible and accessible way to get funds, crypto loans is an option within the world of decentralized finance (DeFi).

Decentralized finance (DeFi) uses blockchain to provide financial services without intermediaries. Crypto loans being a part of DeFi provides a peer to peer lending platform where individuals can borrow and lend cryptocurrency directly to each other. This eliminates the need of traditional financial institutions resulting in faster transaction times, lower fees and more accessibility.

By understanding how a crypto loan works you can make an informed decision if this financial instrument is for you and benefit from it. For more on the transformative effects of fintech innovation, check out our detailed article Fintech Innovation: Revolutionizing Financial Services.

Image by pvproductions on Freepik

Traditional, Collateralized, Flash and No-Collateral Crypto Loans

In traditional finance and the cryptocurrency world, this has a broad spectrum from traditional to collateralized, flash, and no-collateral crypto loans. But, all of these types differ from each other — and appeal to the needs and risk profiles of different categories of the borrowers.

Table of comparison of traditional, flash loans, non-collateral and crypto backed loan

Traditional Loans

Banks and Financial Institutions (they are known for having a large reliance on physical assets as collateral). These are loans that requires a detailed analysis of the borrower’s credit capabilities (credit history, income, relationship between incomes and expenses). It is a process that can take weeks with a lot of paperwork, and someone who checks the checker. Traditional loans have interest rates that depend on a borrower’s credit score, the amount and term of the loan.

Crypto- Backed Loans

Crypto-backed loans, on the other hand, use cryptocurrency as collateral. They can borrow without having to liquidate their digital assets. Because crypto lending platforms use blockchain technology, approval for a crypto-based loan is typically much faster than it would have been with a traditional loan. Since there is less risk to the lender with secured loans, interest rates are typically lower when compared to unsecured borrows. But there is a risk of liquidation with these loans when there is a substantial decline in the value of the cryptocurrency being used as collateral.

Crypto loans without collateral

Crypto loans without collateral are rarer and mostly offered by the business-to-business (B2B) market. Borrowers of these loans are able to borrow the money without collateral-cryptocurrency, which would be a plus for people with scarce crypto holding or wanting to avoid liquidation. Nevertheless, the interest rates on unsecured crypto loans are typically higher because of the additional risk involved for crypto lenders. The eligibility criteria for the crypto loans without collateral are not easily met compared to a high LTV loan.

Flash Loans

Flash loans represent a unique category in the crypto lending space. These ultra-short-term loans allow borrowers to access funds for a single transaction within one blockchain block. No collateral is required as the loan must be repaid within the same transaction. Flash loans are primarily used for advanced financial strategies like arbitrage and yield farming. While they offer powerful opportunities for experienced traders, they also come with significant risks and require a deep understanding of DeFi mechanics.

Each loan type serves different purposes and comes with its own set of advantages and risks.

- Traditional loans offer competitive interest rates, stability and regulatory protection but can be slow and restrictive.

- Crypto-backed loans provide quick access to funds while allowing borrowers to retain their crypto assets, but they carry liquidation risks.

- No-collateral crypto loans offer flexibility but come with higher interest rates.

- Flash loans enable complex DeFi strategies but require advanced knowledge and carry high risks.

Borrowers should carefully consider their financial situation, risk tolerance, and specific needs when choosing between these loan options.

Eligibility Criteria and Tips for Approval

Image by rawpixel.com on Freepik

When you apply for a crypto loan, there are many factors that could influence your chances of getting approved. Being informed of these factors, and taking measures to adopt them will only improve your odds in the eyes of prospective crypto lenders.

Factors that Affects Approval

- Credit History: traditional credit history is not as important in the crypto world but a good credit score still helps.

- Income and Financial Stability: Lenders prefer to see fixed stable income and will grant cryptocurrency loans approval based upon how your assets accumulate over the years.

- Transaction History: Your cryptocurrency transaction history is a big factor. A clean history with no suspicious activity can improve the measure of reputation points.

- Platform Specific Requirements: Each crypto lending platform will have their specific eligibility criteria. It may be in the form of minimum deposit amount, loan or KYC (Know Your Customer) requirements.

Strengthen Your Approval Odds

- Clean Transaction History: Protecting your funds from fraudulent activities or or extreme volatility in your crypto holdings.

- Accurate and Complete Information: The information you give at your application time should be true and updated.

- Co-Signer: If you are not eligible for the loan specifications, a co-signer with good financial profile can increase your approval chances.

- Research and Compare: Each platforms have their own eligibility criteria. Compare more than one platform and research.

Risks and Benefits of No-Collateral Crypto Loans

Image by freepik

There are risks and benefits to no-collateral crypto loans that you should consider before deciding if they are right for you.

Risks

- Higher Interest Rates: No-collateral crypto loans have higher interest rates to collateralized loans, as the risk for lenders worsens.

- Stricter Eligibility Criteria: Some borrowers may not qualify for no-collateral loans due to stringent platform requirements.

- Market Volatility: As a result of the widely fluctuating value of cryptocurrencies, the terms of your loan may be affected and increase the chance of default.

- Liquidation Risk: In order to protect their interest, a lender may liquidate cryptocurrency used as collateral if its value falls below a certain level.

- Platform Risk: The platform (from which you get the loan) itself might be at risk by way of security or financial instability.

- Limited Arbitrage Opportunities: Interest rates, platform fees, market conditions, and other factors may limit the arbitrage opportunities offered by crypto loans without collateral.

Benefits

- Convenience: You can get a no-collateral crypto loan with ultra-high convenience, which means you don’t have to wait for complicated credit checks and submit long documentation.

- Flexibility: Borrowers can use the funds for anything, buying more cryptocurrency, whether they want to buy more crypto, invest in other asset classes or just pay for their own expenses.

- Potential Lower Interest Rates: While no-collateral loans have higher interest rates compared to collateralized loans yet they still tend to be quite competitive for traditional loans especially for those who have a history of good credit like btc holders.

- Arbitrage: Can be used to capture a price margin between markets or exchanges.

No-collateral crypto loans have risks and benefits. Arbitrage is mentioned as both risk and benefit because while it can give you extra returns, it also involves risks and not always profitable. Do consider these factors and your personal financial situation before deciding to take this crypto loan. Once you understand the risks and benefits, making an informed choice about which platform to borrow from should be relatively easier.

Alternative Funding Options

Image by Jcomp on Freepik

Before you try cryptocurrency loans, check up on other finance alternatives and make your decision. Although the flexibility and convenience that come with crypto loans are very beneficial, you might consider looking into traditional financing or other innovative ways.

Credit Cards

Some credit card companies allow you to borrow cryptocurrency through their credit cards, but the interest rates are higher than most crypto loans. However please make sure to read the terms and conditions of how these offers work including interest rates, fees and repayment terms.

Traditional Loans

Another option you might consider for getting funds is through traditional loans such as personal or home equity loans. The interest rates are competitive, but collateral is required and the eligibility criteria are stricter than for crypto loans. It also takes time for traditional loans to be approved.

Sell Crypto Assets

The easiest way to get funds is to sell your excess crypto assets. But the former leads to selling your assets (ultimate tax consequence) and thus have an impact on long term financial investment strategies.

Choose the Right One

That said, the right funding option for you will depend on your individual needs and goals, as well as your comfort level with risk. Think about how much money is required, the amount that you would like to pay back and whether or not you are willing to use collateral. Before you make a decision, be sure to review all of your options and compare interest rates, fees and other terms.

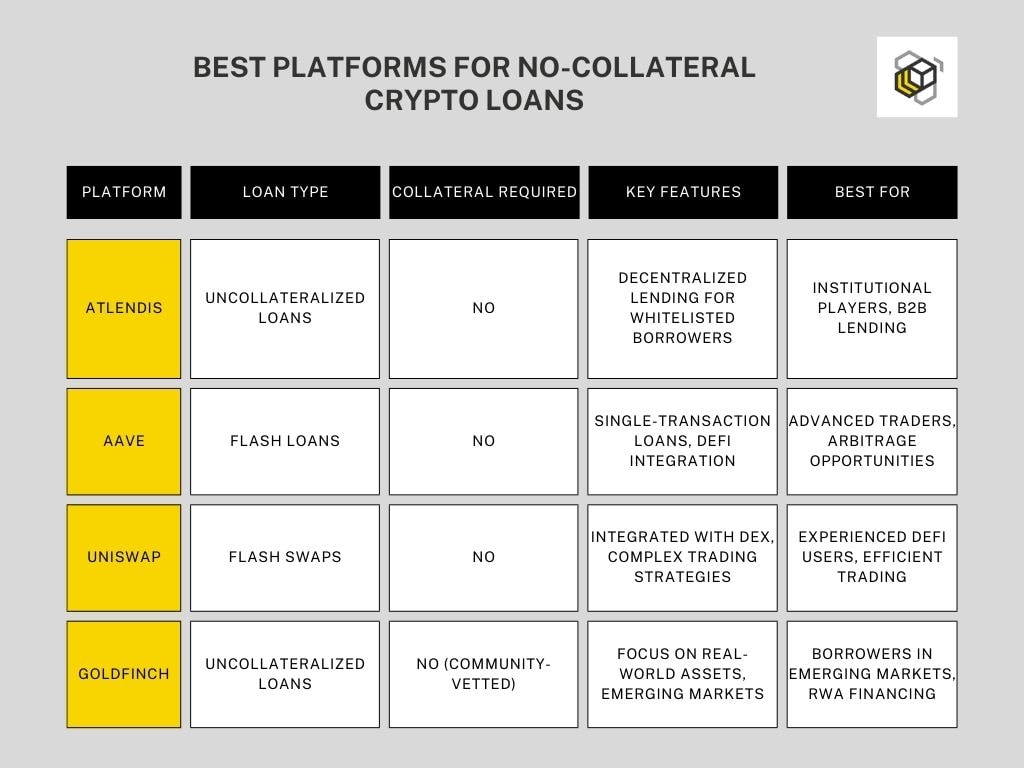

Best Platforms for No-Collateral Crypto Loans

Several platforms are paving the new wave of crypto lending, offering loan services with little or no traditional collateral. Each platform has their own features that are intended for different types of users and risk management, with a range on the amount of borrowed funds.

Atlendis offers uncollateralized loans for institutional players and B2B loans in DeFi. Whitelisted borrowers can access loans without the requirement for any crypto collateral on this decentralized solution platform. Atlendis thus proposes a systemic bridge solution between legacy finance and DeFi for any business or institution active in the crypto-lending space.

Aave uses flash loans, a game-changer in DeFi lending. Traders and arbitrageurs benefit from these uncollateralized loans because they exist only within a single blockchain transaction. Aave’s flash loans are not suitable for traditional borrowing needs, but they have opened up new opportunities for complex financial strategies in the crypto space. The loan amounts on Aave can vary widely, as they are only limited to the liquidity that is available in the protocol at the time of borrowing.

Uniswap – one of the better-known decentralized exchanges, Uniswap also includes support for flash swaps, making it incredibly similar to their flash loan functionality. The underlying concept of this feature is to enable complex trades and arbitrage, while the user can benefit from all the tools Uniswap has to offer — without needing massive capital amounts upfront. It’s a powerful tool for experienced DeFi users looking to maximize their trading efficiency.

Goldfinch pioneered uncollateralized lending on the blockchain and remains a standout. Goldfinch is a DeFi platform based in the US that operates as a community-based vetting system specializing in real world asset funding. The platform is especially useful for borrowers in developing markets where they can obtain crypto loans even if they do not have access to legitimate financial services or traditional collateral.

The above platforms all offer different value propositions by leveraging their unique approaches to crypto lending; the main differentiating factor here was the exclusion of traditional collateral from the delimitation of these solutions. Atlendis is an effective means of covering a crypto holder’s expenses without forcing them to sell their assets, while Aave and Uniswap teach users to use more complex DeFi options such as flash loans and swaps. Goldfinch provides financing for real-world assets users, taking into account some new conditions. The nature of the financial strategy, the will to engage in DeFi, and the user’s experience will determine the best value proposition.

Factors to Consider When Choosing Crypto Loan Platforms

When choosing a crypto loan platform, you should carefully consider several key factors to select an option that matches your needs and risk tolerance best:

Interest rates are a crucial consideration, as they directly impact the cost of borrowing. Ensure that you compare the rates provided by a variety of platforms and choose the most favorable one. At the same time, it is important to note that the lowest one is not always the best choice in case some other terms of a contract fail to meet your requirements.

The range of supported cryptocurrencies is another important aspect. Make sure that the platform can support those types of cryptocurrency you are planning to use as collateral or borrow. This will ensure that your operations with the platform are free of any difficulties.

Repayment terms – the terms related to how you can repay a loan may also significantly affect your borrowing experience. Therefore, try to look for platforms offering flexible opportunities to pay which would correspond to your financial situation and objectives. In this respect, such useful features as an opportunity to repay a loan early and avoid penalties should also be taken into account.

Platform security It is crucial to ensure the complete security of all transactions that you engage in and personal and finance-related data, including the safety and accessibility of any assets provided as collateral. Examine all the available means of protecting your assets at the platforms and consider those things as cold storage of the funds and sophisticated encryption protocols. Remember to also research hacks or other type of security breaches that one or another platform may have faced in the past.

User experience While frequently overlooked, user experience may significantly alter the way you interact with a lending platform and satisfactorily complete return processes. With helpful guides, educational content, interfaces, and contact with customer support representatives, ensure its user experience is top-notch.

Additional Considerations

- Loan-to-Value (LTV) Ratio: Ensure the LTV is favorable to you. The higher the LTV, the more you can borrow against your crypto collateral, but the higher the risk of liquidation.

- Tax: Be aware of the tax implications of taking a crypto loan in your jurisdiction.

- Flash Loans: If you need a very short-duration loan for an arbitrage or other purpose, you could also consider a flash loan. However, understand that flash loans also come with specific risks.

Hopefully, with all this information at hand, you are now in a good position to weigh your options and figure out which crypto loan provider is best suited for you. Note that this industry is very rapidly evolving, and so you need to keep up with market trends and platform updates for the best borrowing experience.

Conclusion

Crypto lending platforms offer innovative financial solutions in the decentralized finance (DeFi) space, providing opportunities for both borrowers and lenders. While truly uncollateralized crypto loans are rare for individual users, various options exist that cater to different needs and risk profiles.Key considerations when exploring crypto lending include:

- Interest rates and loan-to-value (LTV) ratios

- Collateralization requirements and potential liquidation risks

- Security measures and reliability of smart contracts;

- User experience and customer service;

- Taxation problems in your jurisdiction.

Be aware of flash loans, an interesting product centered around specific lending platforms such as Aave and Uniswap, which allow you to take out a loan with no security under one condition: you also return the money by the end of the same transaction. An innovative feature of DeFi lending, they allow professional traders to perform deep arbitrage and other complex strategies. Finally, if you are thinking about big deals, Atlendis is one of the few platforms pioneering undercollateralized lending for institutions and businesses. It is worth repeating that the world of crypto lending is complex, nuanced, and constantly changing. Each new type of loan has its unique set of advantages and dangers, and some may better suit your purpose or strategy than others. Moreover, since cryptocurrency is extremely volatile, it adds another layer of difficulty. To be successful in your borrowing, you need to:

- Educate yourself about borrowing and different types of loans, from collateralized to uncollateralized to flash;

- Stay informed about the market;

- Compare different options and take a broader look at various platforms and their LTV ratios, interest rates, and repayment conditions;

- Assess your financial goals and what risks you are willing to take;

- Consider reaching out to a financial advisor with extensive knowledge of cryptocurrencies;

- Take it slow, especially in DeFi: start with small amounts of lending, especially if you are a beginner.

Remember, successful crypto borrowing requires informed decision-making. Be cautious and well-informed to make the most of crypto-borrowed funds and manage the relevant risks effectively. As the DeFi landscape continues to evolve, new opportunities are emerging. We can expect to see more innovative lending products, improved risk management tools, and greater integration with traditional finance. Stay alert to these developments, as they may open up new possibilities for optimizing your crypto assets, whether you’re earning interest or leveraging them for loans. By staying informed and adaptable, you’ll be better positioned to capitalize on the expanding potential of decentralized finance while mitigating associated risks.