Some Web3 startups take off, raise funds and gain trust. Others hit a wall—hacks, lost assets, investor panic. What’s the difference? Effective blockchain asset management.

Blockchain technology gives you control over your assets but also full responsibility. Smart contracts get exploited, wallets get drained and if you lose access no one can help. Mistakes aren’t just setbacks—they can wipe out everything you’ve built.

Security and asset management aren’t upgrades you add later. They’re what keep your startup running. So how do you protect your assets and manage them effectively without slowing down growth? Let’s dive in.

The Risks Are Real

FTX. Mt. Gox. Two big ones that wiped out billions. Their teams thought they had it all under control—until they didn’t.

Both failed due to poor management of business processes, bad security and no accountability. In the end users and investors paid the price.

Mt. Gox: How Bad Security Led to a 10 Year Disaster

At its peak Mt. Gox handled 70% of all Bitcoin trades. But behind the scenes the security gaps and operational chaos made it an easy target.

Between 2011 and 2014 850,000 BTC disappeared due to multiple hacks. The exchange shut down and customers had to wait 10 years to get part of their money back.

FTX: A $32 Billion Collapse in 10 Days

FTX looked unstoppable — big sponsors, celebrity partnerships, huge growth. But in 2022 it was revealed $8 billion in customer funds were missing.

Withdrawals froze, the company collapsed in 10 days and the CEO was sentenced to 25 years in prison. Some users got refunds but most didn’t—because crypto failures rarely come with a refund.

What This Means For Your Startup

These weren’t just bad luck—these were failures in security, asset management processes and transparency. And they’re not the only ones.

If you’re handling crypto, security isn’t optional. In the next sections we’ll cover practical steps to protect your assets and avoid the mistakes that brought down the giants.

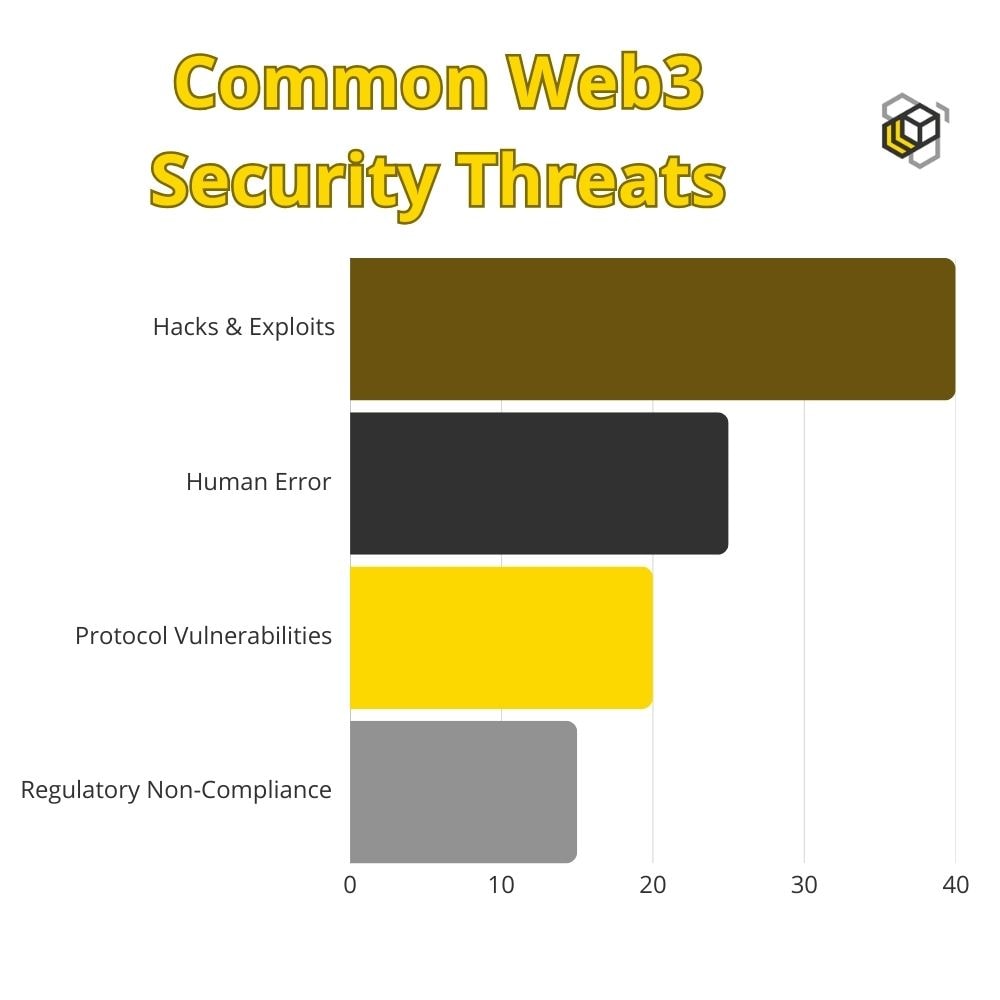

Common Security Threats in Blockchain Asset Management

1. Smart Contract Exploits

Smart contracts are very fast, but not infallible. There are thousands of hackers looking for an easy hack and tiny coding errors have cost even large DeFi platforms millions. Even one unfixed security hole is an open window for assailants. The best defense? There must be regular audits and stringent security checks prior to deployment – once a contract goes live it is hard to get it fixed.

2. Phishing Attacks

Why waste the time and effort to hack your wallet when a scammer can simply get you to give them access to your wallet? There are multiple fake websites, fake smart contracts and malicious links appearing to be trusted platforms. Click the wrong one, and your assets could be signed away in seconds.

3. Lost Wallet Access

Hackers aren’t always the problem—sometimes the biggest risk is simply forgetfulness. People lose fortunes by misplacing their seed phrases. If it’s stored in a cloud service, email or digital note, it’s not safe. If you lose it, there’s no “forgot password” option in crypto. Write it down. Store it offline. Protect it like your life savings depend on it—because they might.

4. MEV (Maximal Extractable Value) Attacks

DeFi isn’t always fair play. MEV attacks let powerful traders manipulate transactions, pushing their trades ahead of yours by paying higher fees. Regular users end up paying more or getting worse prices without even realizing it. The solution? Use private transactions or MEV resistant protocols when possible—because in blockchain, speed isn’t just about efficiency, it’s about survival.

The Biggest Risk: Human Error

No exploit, scam or attack beats human mistakes. 80% of security breaches happen because someone clicked the wrong link, used an unverified service or skipped basic security steps like 2-factor authentication. The best way to stay protected is to stick to trusted platforms, follow strict security practices and assume that if something looks too good to be true, it probably is.

How Web3 Startups Should Store Crypto Assets Safely

When it comes to Web3, security can’t be an afterthought—it needs to be baked in from day one. But here’s the challenge: how do you ensure blockchain asset management keeps your funds secure while your business moves fast?

Some assets need to be locked away for the long term, while others must be ready to spend in an instant. And that’s just the beginning—who has access to what, how transactions get approved, and how you recover assets if something goes wrong all play a role in asset management.

The best approach depends on your startup’s needs. Let’s dive into the different types of wallets and how they can fit into your Web3 business.

Cold Storage: The Unbreakable Safe

Cold wallets are the gold standard for security. Since they store private keys offline, they’re hack proof. This makes them perfect for long term storage – investor funds, treasury reserves, capital that doesn’t need to move often.

Popular options like Ledger and Trezor allow assets to be accessed only when the device is physically connected to a computer. Transactions must be manually signed, which reduces the risk of unauthorized transfers to almost zero.

But here’s the tradeoff: convenience. If you need to make frequent transactions, cold storage will slow you down. That’s why most projects use it in conjunction with more flexible blockchain technology solutions.

Hot Wallets: Speed vs. Security

If cold storage is a locked safe, hot wallets are like keeping cash in your pocket. They’re always connected, making them ideal for frequent transactions, DeFi interactions, and NFT marketplaces.

Platforms like MetaMask, Trust Wallet, and Phantom provide seamless access to decentralized apps (dApps). They allow quick trades, staking, and lending—but that accessibility comes with a higher risk of hacks.

Hot wallets store private keys online which makes them more vulnerable to phishing attacks or malware. To stay safe you’ll want to layer in some strong protections – think HSMs, multi-factor auth, clear rules around who can access your wallets. Hot wallets are great for day to day operations but don’t keep large sums in them. Use them for enough to keep your business moving without risking your bigger reserves.

Shared Control: Why Multi-Sig Wallets Matter

If you’re running a Web3 startup managing pooled funds—whether it’s a DAO, an investment fund, or a multi-founder project—handing full control to one person is a recipe for disaster. That’s where multi-sig wallets come in as a key asset management tool.

Instead of relying on one decision maker, with multi-sig wallet approach, several people should approve a transaction before it goes through. A setup like Gnosis Safe lets you set rules like “at least 3 out of 5 signers must approve,” enhancing asset management by keeping transactions secure and preventing any single person from making unauthorized moves.

However, delays may occur. If a signer is out of reach when an urgent transfer is needed, things can stall. To overcome this hurdle, many teams mix security with efficiency—they use multi-sig wallets for important decisions and smart contracts for routine transactions.

Smart Contract Wallets: The Future of Asset Management?

Smart contract wallets take security to the next level by automating governance and access control. Instead of relying on manual approvals, these wallets enforce security rules directly on-chain.

Take Argent and SafePal, for example. Their strong sides are:

- Social recovery: No need for seed phrases—trusted accounts can help restore access.

- Spending limits: Preventing large transactions without extra approvals.

- Role-based permissions: Different users can have different levels of access.

This flexibility makes them a powerful option for DeFi startups. But they come with a key risk: smart contract bugs. If there’s a flaw in the contract, it could lead to funds being drained immediately. That’s why regular audits and real-time monitoring are absolutely essential.

Security in Web3 isn’t just about technology—it’s about processes and discipline. Leveraging distributed ledger technology with the right mix of wallets will enhance operational efficiency, helping your startup stay secure, move fast, and scale efficiently in a fast-changing market.

Smarter Blockchain Asset Management: How Startups Secure Digital Assets

For Web3 startups, securing digital assets is about more than protection—it’s about using blockchain technology to make assets work for you. By optimizing liquidity and reducing risk you can be more competitive and efficient.

Optimizing Liquidity and Efficiency

Idle assets are a missed opportunity. Integration of blockchain asset management with DeFi protocols like AAVE, Compound and Curve can bring 2-10% extra returns depending on the asset and protocol. This is a far better use of capital than letting assets sit unused.

Automated smart contracts and decentralized payment systems eliminate manual tasks and outdated systems. This reduces fraud, speeds up transactions and reduces reliance on intermediaries.

For startups this also means more control over liquidity, so your assets are accessible and secure. It’s a way to make your funds work harder while staying agile in a fast moving market.

Security Through Asset Distribution

A single breach shouldn’t cripple a company. Asset management firms and blockchain platforms use cold storage for long-term reserves while keeping operational funds in secure hot wallets. This layered approach ensures operational efficiency while protecting against security threats.

Lower Costs and More Control

Traditional platforms involve intermediaries or third parties which add complexity and cost. Blockchain asset management eliminates third parties by running on the blockchain thus eliminating all third party related issues. Only blockchain gas fees apply.

Plus no direct communication between participants so the platform relies on automated interactions with the smart contract reducing operational overhead and minimizing errors.

Transparent and Immutable Data

All trading activities are stored on the blockchain so it’s transparent. Information is public, immutable and fully traceable so businesses can track transaction history with confidence – no data manipulation or inaccuracies to worry about.

Web3 Security Mistakes That Cost Millions

Overlooking security in Web3 is a mistake—it’s an expensive one. Hacks have drained projects of hundreds of millions in seconds. The Wormhole attack? $325 million gone. The Ronin bridge exploit? $600 million lost.

In addition to hackers, improper asset management can lead to legal issues, especially for DAOs. Human error, such as losing access to private keys, can have devastating consequences, leaving projects vulnerable.

One golden rule: never store seed phrases online. No Google Docs, no notes apps, no email accounts. If it’s online, it’s at risk. The safest way? Write it down. Store it somewhere secure.

5 Simple Steps to Keep Startup Funds Secure

Protecting digital assets isn’t just about locking them away—it’s about balance. Security, accessibility, efficiency. At Cyber Bee, we help Web3 startups build security strategies that work. No fluff, just steps.

1. Find the Risks

First, find the weak spots. Are your assets stored securely? Are your smart contracts audited? What about operational workflows? Catch the risks before they become disasters.

2. Use Wallets Correctly

Cold wallets are for reserves. Hot wallets are for daily use. Never mix them up. And always enforce strict access controls—one compromised wallet shouldn’t put everything at risk.

3. Multi-Sig & Smart Contract Audits

No one person should have full control over project funds. Multi-sig wallets require multiple approvals before transactions go through. Think of it as a safeguard against internal mistakes or rogue actors.

Regular smart contract audits are just as important. A single vulnerability means instant losses. Don’t wait until it’s too late.

4. Monitor Transactions in Real Time

One of the best things about blockchain technology is transparency. Use automated monitoring tools to watch transactions and catch any suspicious activity early. The quicker you act the less damage you’ll suffer.

5. Stay Up to Date

Threats move fast, so should your security. Update your security protocols, review compliance and refine your processes. An outdated security strategy leaves you exposed so make it a priority. Keep risk low, keep transparency and keep control.

Security isn’t a feature. It’s the base. Ready to build a secure plan for your blockchain asset management? Contact Cyber Bee and we’ll help you create a tailored asset management plan.