Fintech operates in a high risk environment where security, speed and regulatory compliance are non negotiable. Traditional financial systems are inefficient and public blockchains are transparent but lack privacy and performance. Private blockchains offer a solution – security and control for fintech companies without sacrificing scalability. This article looks at the current solutions and how private blockchain is changing financial services.

Private Blockchain Technology: A Game Changer for Fintech’s Key Issues

The financial industry processes millions of transactions every day and needs high security, regulatory compliance and operational efficiency. But legacy systems and public blockchains can’t deliver.

Where Traditional Systems Fail

Centralised databases are the backbone of financial institutions but come with inherent risks. A single point of failure in a centralised ledger means a cyber attack or technical outage can bring down the whole system and result in data breaches and financial loss. Integrating multiple systems across different banking networks is expensive and complex and often requires custom built solutions to make them compatible.

For tasks such as loan approvals and compliance checks, traditional systems also rely on manual processes, which can lead to errors and inefficiencies. Cross border transactions suffer from settlement delays due to batch processing which affects liquidity and slows down global trade.

Why Public Blockchains aren’t the Answer

Public blockchains like Ethereum and Bitcoin introduce a decentralised nature which brings transparency and security. But for fintech applications they have significant drawbacks. The open, permissionless nature of a public blockchain network means anyone can join the network which creates data privacy and control issues. Sensitive data like user identities and financial transactions are visible to all participants which is a big problem for regulatory compliance.

Scalability is another issue. Public blockchains rely on consensus mechanisms like proof of work or proof of stake which are secure but slow and limited in terms of transactions per second. The inefficiency combined with high transaction fees due to network congestion makes public chains unsuitable for high frequency financial transactions. And without a central authority in public blockchain networks it’s hard to govern and enforce compliance and security.

How Private Blockchains Fix These Problems

Private blockchains solve fintech problems by offering controlled access, enhanced security and regulatory compliance. Unlike public blockchains where transactions are visible to everyone, private blockchains allow financial institutions to set custom governance rules, permissioned access and transaction privacy. This means compliance with financial regulations and efficiency and reduced risk.

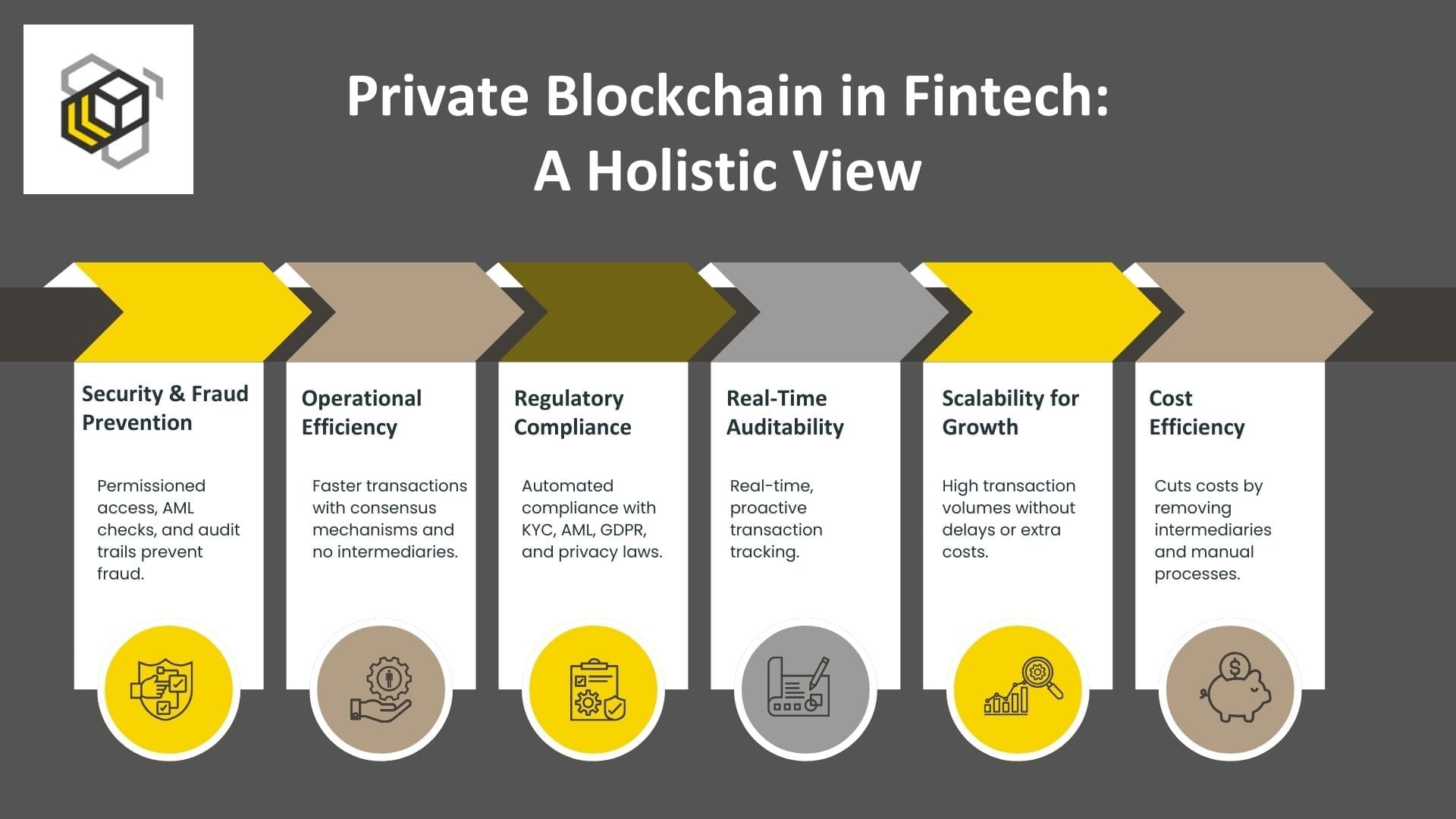

Security & Fraud Prevention

Private blockchains have robust security features to prevent fraud. With consortium governance and permissioned access, unauthorized transactions are blocked and financial institutions have full control over who has access to sensitive data. This is especially useful in fraud detection and prevention where unauthorized activities can be flagged immediately. For example a private blockchain based payments network can use built in anti-money laundering (AML) checks to flag suspicious transactions in real time, freeze them and trigger an audit trail without human intervention.

Operational Efficiency

Efficiency is a big advantage of private blockchains. Traditional financial systems involve multiple intermediaries and slow processes, private blockchains have faster consensus mechanisms. Transactions on these blockchains settle in seconds, no delays that would happen in legacy systems. This saves time and improves overall customer experience especially when dealing with high volume of transactions like payments and insurance.

Regulatory Compliance

Regulatory compliance is one of the biggest problem for fintech companies. Governments and financial regulators demand strict compliance to regulations like Know Your Customer (KYC), Anti-Money Laundering (AML) requirements and data privacy laws like GDPR and Canada’s PIPEDA. Failure to comply can result to heavy fines, legal troubles and loss of customer trust.

This is where private blockchains excel — not just as an operational efficiency tool but as a compliance solution. Financial institutions can implement KYC, AML checks and audit trails on-chain. Smart contracts can automate compliance by flagging non compliant transactions so firms are ahead of the regulations.

For example a blockchain based KYC system allows for secure identity verification in seconds. Once a customer’s credentials are verified by one institution they can be shared securely with others, no more redundant checks and faster onboarding process. This also reduces fraud as blockchain based identities are harder to counterfeit.

Real-Time Auditability and Fraud Detection

Private blockchains record every transaction on an immutable ledger so audits are continuous and real-time. In traditional financial systems audits are slow and reactive, auditors review months of data to find irregularities. By the time fraud is detected the damage is already done.

With a private blockchain regulators and financial institutions can access real-time financial data, improve oversight and respond faster to suspicious activity. This proactive risk management is shown by the Bank of Canada’s exploration of blockchain based audit systems which proves the value of real-time visibility for risk mitigation.

Scalability

Private blockchains also offer scalability benefits over public blockchains. Public networks can be congested and have high fees, private blockchains are optimized for faster and more efficient transaction processing. Financial institutions can process more transactions without slowing down or increasing cost.

Regulators Are Catching Up

Global regulators are starting to recognize the role of blockchain in risk management and compliance. In Canada the Office of the Superintendent of Financial Institutions (OSFI) is looking into blockchain, other global bodies like the SEC and FATF are pushing for clearer blockchain compliance standards. For fintech firms adopting private blockchains early gives them a competitive advantage and prepares them for upcoming regulatory changes.

By building compliance features into the core of their systems private blockchains are changing fintech’s approach from reactive rule following to proactive risk prevention. Instead of worrying about audits, fraud or compliance issues after the fact financial institutions can embed trust and security into their transactions from day one.

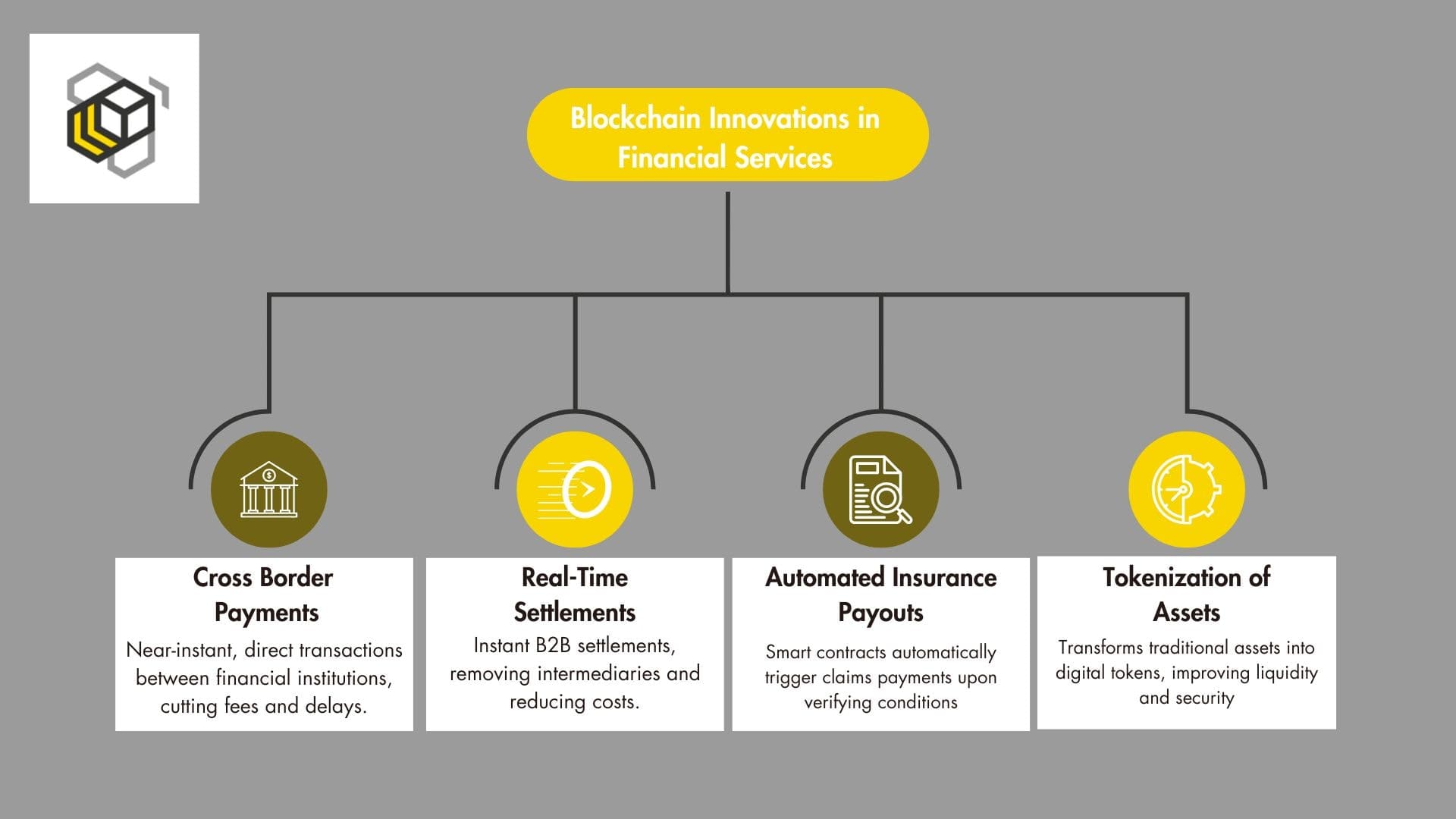

Private Blockchain Use Cases in Fintech

Private blockchains are transforming financial services by addressing inefficiencies in payments, settlements, insurance and asset trading. Here are the areas where this technology is making an impact.

1. Cross Border Payments: Reducing Delays and High Fees

International transactions go through multiple intermediaries which leads to slow processing times, high fees and compliance bottlenecks. The SWIFT network for example relies on correspondent banks which introduce delays and add cost.

Private blockchain networks simplify this process by enabling direct, near instant transfers between financial institutions. No need for third party validation, banks can reduce transaction fees and improve liquidity management.

RippleNet is a great example, it uses blockchain to enable real-time gross settlements. By enabling direct transactions between banks and payment providers RippleNet increases transparency and predictability and reduces counterparty risk.

2. Real-Time Interbank Settlements: Reducing Dependency on Clearinghouses

Traditional interbank settlements rely on central clearinghouses which leads to operational inefficiencies and high cost. Settlement cycles take days which impacts liquidity and increases financial risk.

Private blockchains enable banks to settle transactions directly, eliminating intermediaries and reducing processing time to minutes. This speeds up fund availability, reduces reconciliation errors and lowers operational cost.

J.P. Morgan’s Kinexys (formerly Onyx) is a great example. Integrated with Mastercard’s Multi-Token Network (MTN) Kinexys enables instant B2B settlements, replacing slow batch processing with blockchain based real-time transactions.

3. Automated Insurance Payouts: Smart Contracts for Instant Claims

Insurance claims are often delayed, have fraud risks and manual processing inefficiencies. Traditional systems require lots of paperwork and human oversight which increases administrative cost and payout time.

By using smart contracts private blockchains automate claims processing. When predefined conditions are met—such as verified damage reports—payments are triggered instantly without human intervention.

Mastercard’s Multi-Token Network (MTN) integrates blockchain powered smart contracts to automate insurance payouts. This reduces human error, speeds up settlements and enhances fraud detection, improves insurer efficiency and customer experience.

4. Tokenization of Assets: Unlocking Liquidity in Financial Markets

Trading traditional financial assets like stocks, bonds or real estate is slow, costly and limited to institutional investors. Settlement delays, counterparty risk and regulatory constraints makes transactions even more complicated.

Tokenization—converting real-world assets into digital blockchain based tokens—enables faster, more secure and more accessible trading. Private blockchains ensure regulatory compliance while reducing settlement risk.

Bakkt, originally launched as a cryptocurrency custody service, has expanded into tokenized assets, enabling institutions to trade and manage digital financial instruments. By bridging traditional finance and blockchain platforms like Bakkt makes asset trading more liquid and cost effective.

Challenges of Private Blockchains and How to Overcome Them

Private Blockchains in Fintech

Most fintech companies already have databases, payment processors and compliance tools—adding a private blockchain network isn’t plug-and-play. These systems don’t talk to each other, public and private blockchains so companies use APIs and blockchain bridges to connect them without exposing private data. Spunta Banca DLT in Italy solved this for interbank reconciliations, allowing authorized participants to verify transactions while keeping sensitive information private.

Cost and Scale

A private blockchain isn’t cheap. It needs restricted access, encryption and governance tools. Instead of full adoption, companies start small. The MonetaGo network in India first secured invoice financing against fraud before expanding to new use cases, reducing cost while keeping data intact.

Regulatory Uncertainty

Fintech regulations differ by country. Engage with regulators early to avoid compliance hurdles. Singapore’s Project Ubin, a permissioned network for interbank payments, worked with the Monetary Authority of Singapore from day one.

Who has Access?

Unlike public blockchains, a closed network limits access. Governance rules define who can see transactions, approve records or verify digital identity. In Spain Alastria, a consortium blockchain, allows financial institutions to share data securely while keeping sensitive information private.

Done right private chains can be more efficient, more secure and more compliant. But success depends on seamless integration, cost control and clear governance.

Here’s a summarizing table that highlights the key challenges of private blockchains in fintech and the corresponding solutions:

| Challenge | Description | Solution |

|---|---|---|

| Integration with Existing Systems | Existing databases, payment processors, and compliance tools need to connect with private blockchains. | Use APIs and blockchain bridges for secure, private data connection (e.g., Spunta Banca DLT). |

| Cost and Scale | Private blockchains are expensive to implement and maintain. | Start with small-scale solutions and expand (e.g., MonetaGo in India for invoice financing). |

| Regulatory Uncertainty | Regulations for fintech differ across countries. | Engage early with regulators to ensure compliance (e.g., Singapore’s Project Ubin). |

| Access and Governance | Closed networks limit who can access and validate transactions. | Define clear governance rules and access protocols (e.g., Alastria in Spain). |

Private Blockchain Deployment Models: On-Premises vs Cloud

Before we get into the specific platforms, we need to consider the deployment model. Fintech companies can host their private blockchains on-premises or in the cloud.

On-premises deployment gives you full control. You own and manage the infrastructure, you can customize and potentially lower latency. But it comes at a cost. High initial investment in hardware and software is required and maintaining and scaling the system requires a lot of IT resources.

Cloud-based deployment leverages the agility and scalability of cloud providers like AWS, Azure and Google Cloud. It accelerates deployment, reduces initial cost and allows for flexible scaling on demand. Cloud providers offer managed blockchain services, simplifying operations and reducing the load on internal IT teams. But there are concerns around data sovereignty and vendor lock-in.

Security is key in both models. On-premises deployment requires physical and cybersecurity measures. Cloud-based solutions rely on the security of the cloud provider but companies still need to implement strong access controls and encryption.

Costs differ greatly. On-premises deployment requires high upfront and operational costs. Cloud-based solutions are pay-as-you-go but costs can spiral out of control if not managed.

Scalability is important. On-premises scaling requires a lot of planning and investment. Cloud-based solutions provide seamless scaling, allowing businesses to adapt to changing demand and grow efficiently.

In the end it all comes down to the specific needs and priorities of the fintech company. Budget, technical expertise, regulatory compliance and scalability requirements need to be considered to determine the best approach.

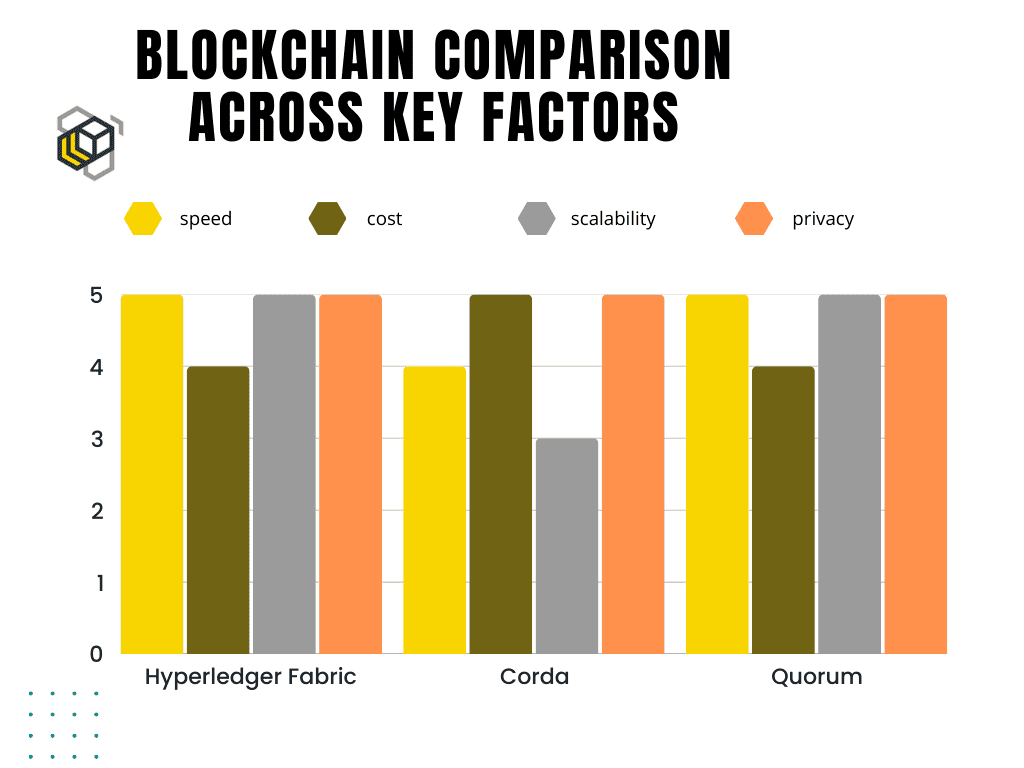

How to Choose the Right Private Blockchain Network

Choosing the right private blockchain for your fintech operations isn’t just about picking the most popular platform — it’s about finding the one that fits your use case. Some companies need a secure way to process payments between institutions, others need to automate financial contracts or digitize assets. It depends on transaction speed, privacy requirements and how well the system integrates with existing infrastructure.

Here are three private blockchain solutions, their use cases and why they might be right for your fintech company.

Hyperledger Fabric – Corporate Payments and Document Management

Financial institutions processing large volumes of corporate payments and regulatory documentation need a blockchain that prioritizes security, efficiency and controlled data access. That’s where Hyperledger Fabric comes in. This permissioned blockchain developed by the Linux Foundation is for enterprises that require strict governance, customizable security settings and a modular architecture.

One of its best features is private channels, which allows different parties in a transaction to share data without exposing it to the entire network. This is critical in trade finance where sensitive documents like letters of credit and invoices need to be exchanged between banks and suppliers. Instead of relying on slow paper-based verification, companies can use smart contracts (chaincode) to automatically validate and process the transactions.

For cross-border settlements, Hyperledger Fabric has a major advantage: pluggable consensus mechanisms. Public blockchains rely on energy intensive mining, Hyperledger allows businesses to choose faster and more efficient validation methods. So international payments can be settled in seconds not days, reducing liquidity risks and improving cash flow for companies operating globally.

If your fintech business is B2B, regulatory reporting or corporate finance, Hyperledger Fabric has the security and flexibility you need to simplify operations.

Corda – Interbank Settlements and Financial Contracts

Other blockchains record every transaction across all network participants. Corda is different, only those involved in a transaction have access to its details. So it’s perfect for financial institutions handling high value transactions like syndicated loans, interbank settlements and complex regulatory reporting.

One of the biggest headaches in traditional banking is the time it takes to settle large financial agreements. Syndicated loans for example involve multiple banks working together to fund a borrower. Each institution needs to verify loan terms, check compliance requirements and ensure payments are processed correctly – a process that takes weeks.

With Corda, stateful smart contracts record and enforce every step of the agreement. No more back and forth paperwork, no human error and faster deal closure. Notary services on the Corda network prevent double spending and unauthorized changes so transaction integrity is guaranteed.

Interbank settlements also benefit from Corda’s point to point transaction model which eliminates the need for third party clearing houses. Instead of processing payments through multiple intermediaries, banks can exchange digital assets directly, reducing transaction costs and settlement times from days to minutes.

For fintech businesses working with banks, insurance providers and regulatory bodies, Corda provides a real-time, legally enforceable blockchain framework to increase trust and efficiency in financial agreements.

Quorum – Asset Tokenization and High Throughput Transactions

The financial industry is going digital and Quorum is one of the leading blockchain solutions for this transformation. Built as an enterprise version of Ethereum, Quorum is for fintech businesses that deal with asset tokenization, DeFi and digital wallets.

Tokenization means converting real world assets – stocks, bonds or real estate – into digital tokens that can be traded more efficiently. Traditional asset trading is slow, costly and limited to institutional investors. With Quorum businesses can issue digital securities that can be transferred and settled in real-time, reduce counterparty risk and eliminate unnecessary intermediaries.

One of Quorum’s key features is private transactions, so sensitive financial data is only shared between the parties involved. This is critical for institutional grade asset trading where large transactions could move the market if made public.

As Quorum is Ethereum compatible, businesses can also build and deploy decentralized applications (dApps) that integrate with existing financial infrastructure. This is great for fintech firms looking at DeFi applications where users can access lending, borrowing and trading services without relying on traditional banking intermediaries.

Also Quorum is optimized for high transaction throughput so it’s a good choice for digital payment networks and financial institutions that process large volumes of microtransactions. It runs on cloud infrastructure so deployment and scalability is easy.

If your fintech business is building financial markets through digital assets and decentralized solutions, Quorum is a high performance blockchain platform that connects traditional finance to the new digital economy.

Conclusion

Private blockchains aren’t a magic fix, but they solve real problems in fintech—compliance, security, and data integrity—when built and integrated the right way. It’s not always easy. Regulations shift, costs add up, and connecting with existing systems takes work. But for fintech firms dealing with high-stakes transactions and sensitive data, the benefits are worth it.

At Cyber Bee, we’ve helped businesses navigate these challenges, designing private blockchain networks that actually fit their needs. No overcomplication, no unnecessary tech — just real solutions that make compliance and security a little less painful. If you’re thinking about blockchain for your fintech operations, we’re always happy to chat and figure out what makes sense for you.