Solana is crushing it in 2025 and DeFi is getting a lot cooler because of it. Solana runtime powered by Anchor is fast and cheap so developers and DeFi enthusiasts love it. But with so many projects in the Solana ecosystem which Solana dApps truly stand out?

At Cyber Bee we’ve reviewed the most impactful Solana dApps that are changing DeFi this year. Whether you’re a trader, investor or builder this guide will help you connect with the right dApps and grow in the ecosystem.

Why Solana is a DeFi powerhouse?

Solana has earned its name in DeFi space due to its innovative features that provide unmatched performance and scalability for decentralized applications. If you’re new to dApps or want a deeper understanding of how they work, check out this guide on decentralized applications.

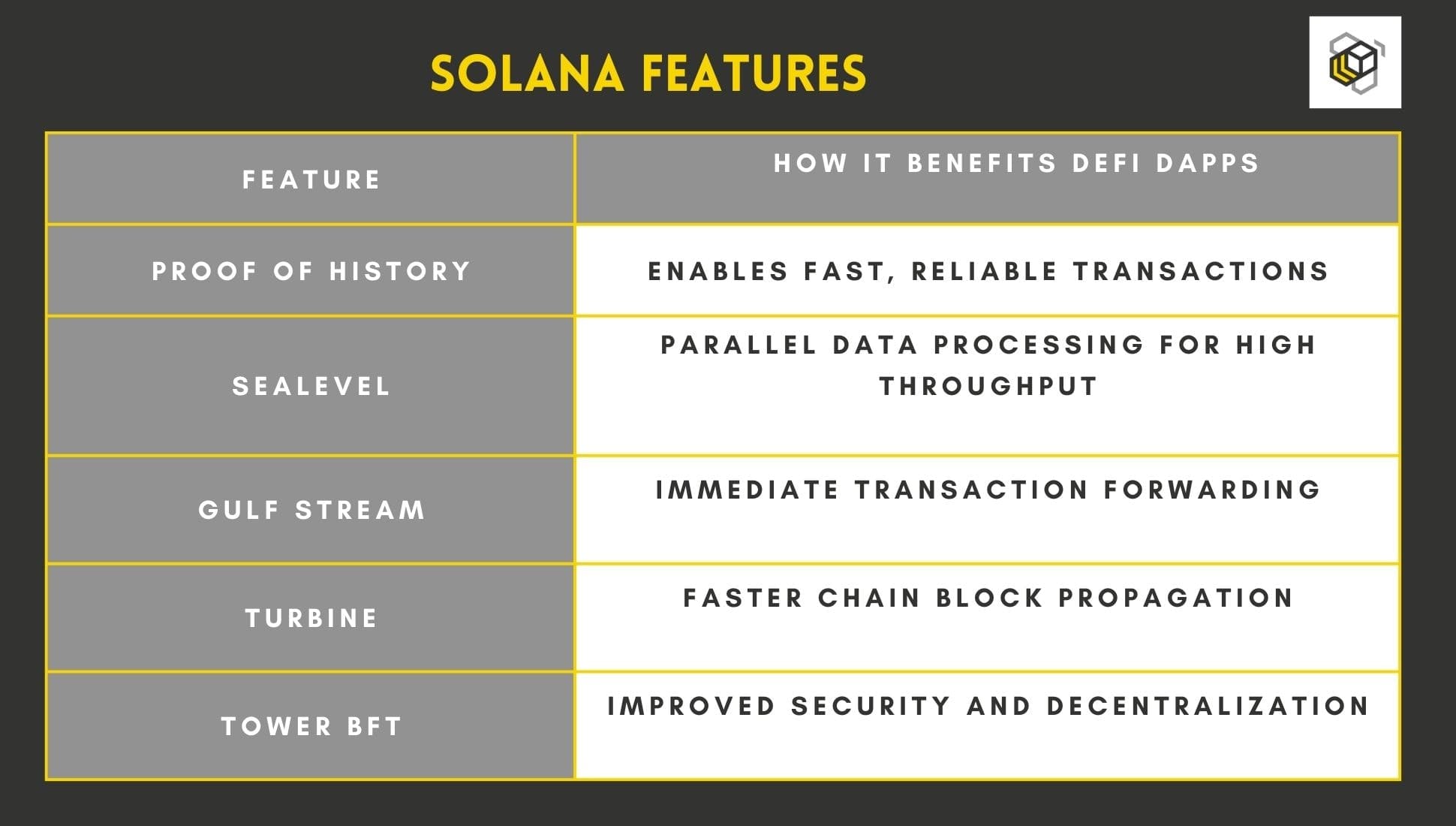

Here’s how each of these features benefits DeFi dApps:

- Proof of History (PoH): By having a unique timestamping system Solana can order transactions without extensive validation, making them faster and more reliable. This reduces congestion and cuts transaction fees which is crucial for DeFi applications to work smoothly.

- Sealevel: Solana can process multiple smart contracts at the same time so it can handle more transactions in a shorter amount of time. This is especially valuable for high demand DeFi activities like trading or lending so the network doesn’t slow down as usage increases.

- Gulf Stream: This protocol forwards transactions to validators as they’re created, reducing the time it takes to confirm transactions. For DeFi enthusiasts, this means faster execution when making trades or transferring assets.

- Turbine: Solana’s block propagation system speeds up the delivery of data across the network, improving scalability and transaction speed. This is perfect for DeFi applications that need to operate with minimal delays and high transaction volumes.

- Tower BFT: Solana uses Byzantine Fault Tolerance (BFT) to keep the network secure and decentralized. Even if some validators act maliciously the system can still reach consensus so the platform is reliable for DeFi projects.

Which Solana dApps are leading in 2025?

Here’s our list of top Solana dApps that are using Solana’s architecture for speed, scalability, and security:

| Name | Role | Technical Edge |

| Raydium | Hybrid AMM DEX with order-book integration | Uses Sealevel for sub-second swaps and low slippage. |

| Jupiter Exchange | Liquidity aggregator across 20+ DEXs | Leverages Gulf Stream for rapid forwarding; supports limit orders |

| Drift Protocol | Perpetuals trading with leverage | Integrates Tower BFT for secure, low-latency, high-frequency leveraged trading. |

| Marinade Finance | Liquid staking protocol | Uses Turbine for fast block propagation; enables liquid staking via mSOL. |

| Jito | MEV-optimized liquid staking | Applies Proof of History for swift reward distribution and reduced centralization. |

| MarginFi | Cross-margined lending/borrowing platform | Runs on Solana’s parallel runtime and integrates with Drift for unified risk management. |

| Kamino Finance | Automated yield strategies | Executes efficient, simultaneous yield strategies using Sealevel. |

| Save (formerly Solend) | Lending/borrowing protocol | Employs Gulf Stream for near-instant loan approvals. |

| Ondo Finance | Tokenized real-world assets (RWAs) | Leverages high throughput for continuous, 24/7 asset settlement. |

| Orca | User-friendly DEX | Uses Proof of History to minimize slippage and ensure fair price execution. |

Each of these Solana dApps shows how Solana’s high performance, secure and scalable infrastructure supports various DeFi solutions. At Cyber Bee we’re monitoring these developments so developers and users have the practical insights to build and connect on a next generation blockchain.

How Do These dApps Benefit Users?

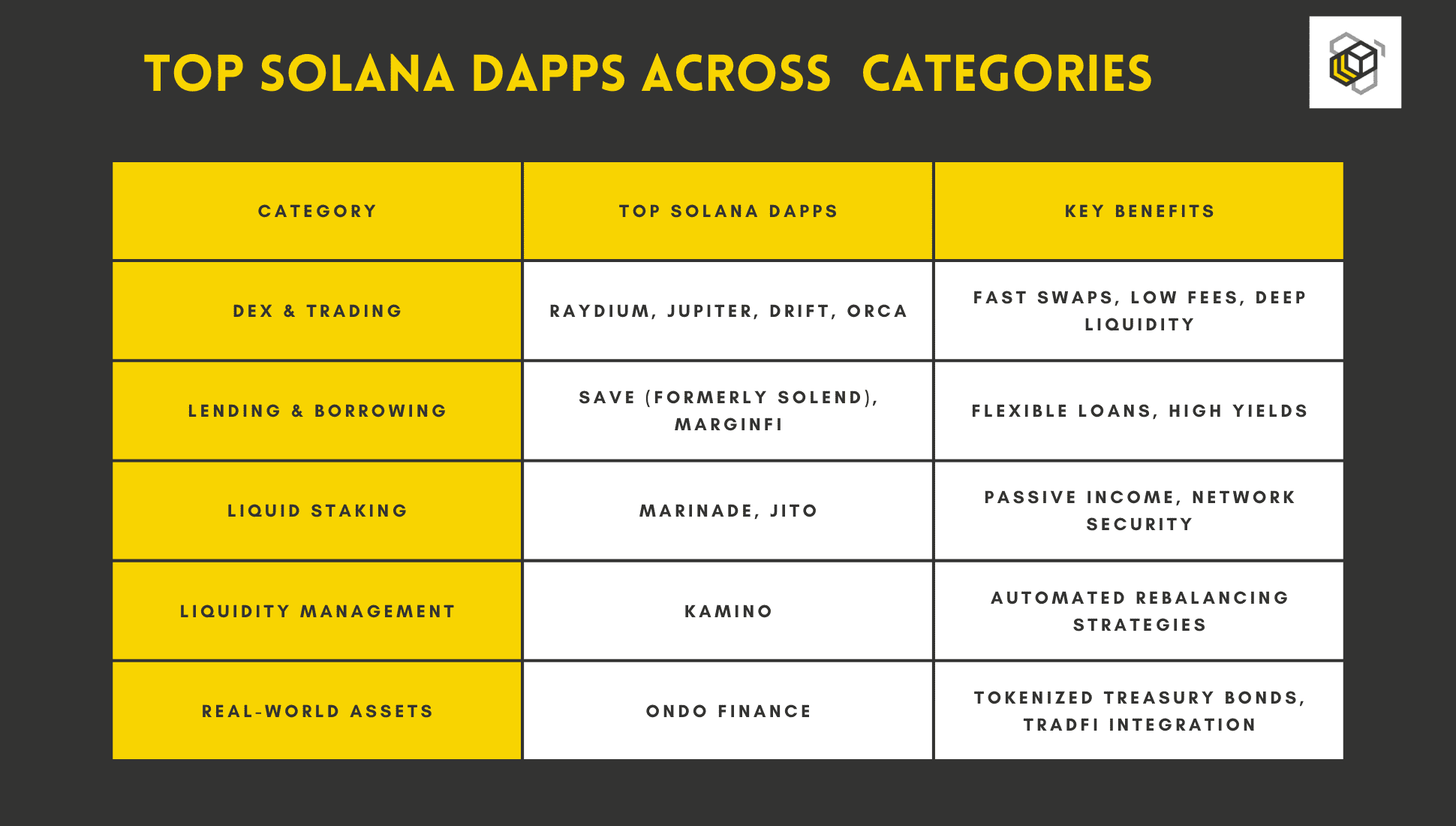

DEX & Trading

Top dApps: Raydium, Jupiter, Drift, Orca

Key Benefits: Fast swaps, low fees, deep liquidity

These decentralized exchanges leverage Solana’s high-performance infrastructure to offer ultra-quick trading with minimal transaction fees. Raydium uses Sealevel for parallel processing, so swaps are sub-second. Jupiter aggregates liquidity across multiple DEXs for optimal trading routes. Drift is for perpetuals trading with 10x leverage. Orca features an intuitive interface and concentrated liquidity pools.

Lending & Borrowing

Top dApps: Save, MarginFi

Key Benefits: Flexible loans, high yields

Save offers lending and borrowing with dynamic interest rates and isolated lending pools. MarginFi is for decentralized lending with a focus on risk management with a robust risk engine and health factor system.

Liquid Staking

Top dApps: Marinade, Jito

Key Benefits: Passive income, network security

These protocols allow Solana adopters to stake SOL while keeping liquidity. Marinade issues mSOL tokens that represent staked SOL. Jito offers MEV-optimized liquid staking with validator-free pools to reduce centralization risks.

Liquidity Management

Top dApp: Kamino

Key Benefits: Automated rebalancing strategies

Kamino Finance automates and optimizes concentrated liquidity management on Solana making it easy for Solana dApp participants to earn yield through liquidity provision.

Real-World Assets

Top dApp: Ondo Finance

Key Benefits: Tokenized treasury bonds, TradFi integration

Ondo Finance brings real-world assets to Solana DeFi, tokenized treasury bonds and TradFi integration. To dive deeper into how blockchain assets are transforming the digital world, check out this article on tokenized assets.

This Solana dApp ecosystem shows the blockchain can power many DeFi activities, from trading and lending to liquidity solutions and real-world assets.

Which dApp in the Solana Ecosystem Should You Use?

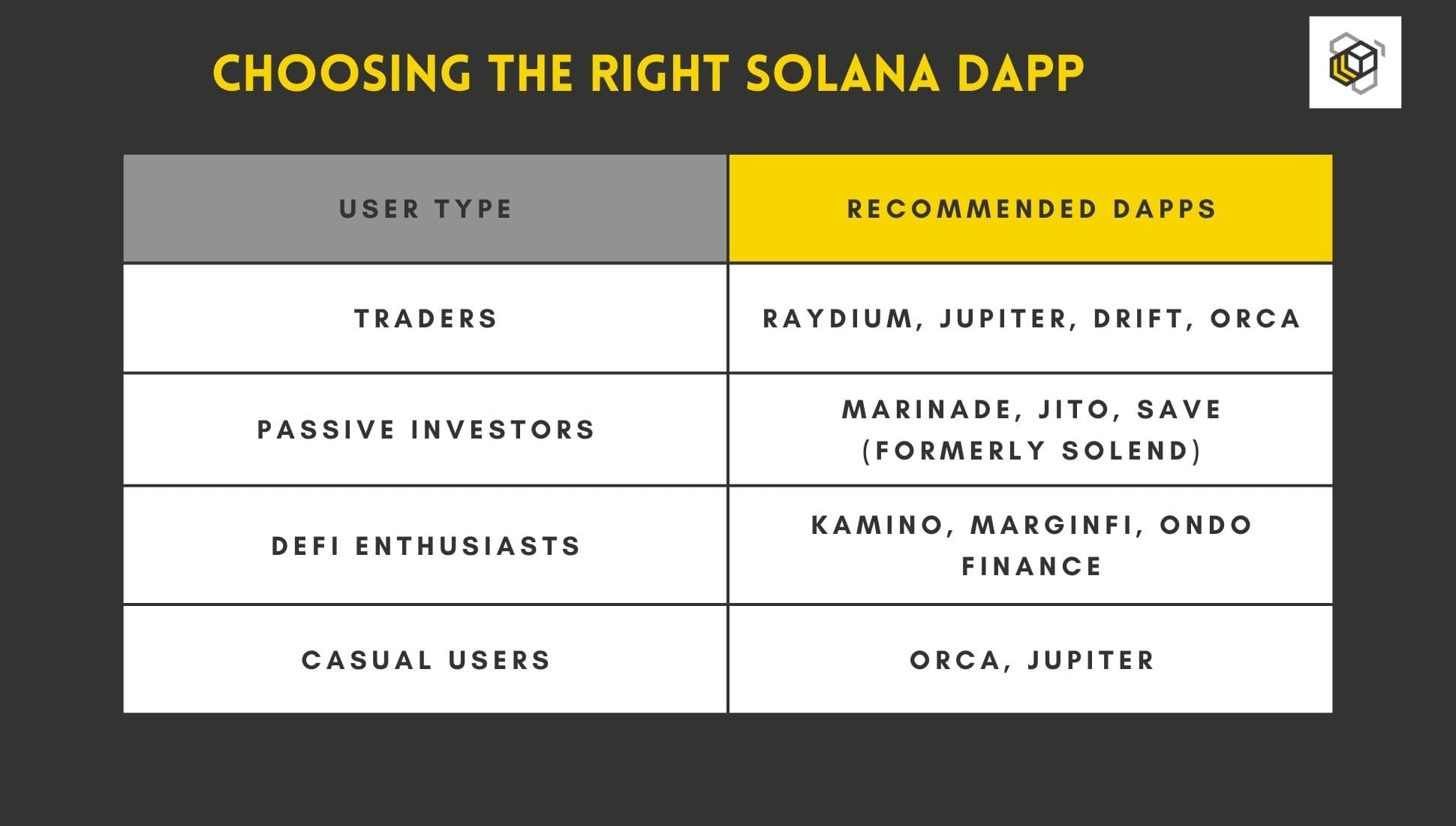

Choosing the right dApp depends on your role and goals in the Solana blockchain.

- Traders: For efficient, low-fee trading with deep liquidity, try Raydium, Jupiter, Drift, or Orca. These top Solana dApps leverage Solana’s high-speed infrastructure for rapid transactions and minimal fees.

- Passive Investors: If you want to earn without active management, Marinade and Jito offer liquid staking, Save has lending with flexible loans and high yields.

- DeFi Enthusiasts: For those exploring advanced DeFi features, Kamino has automated yield strategies, MarginFi has cross-margined lending/borrowing and Ondo Finance brings real-world asset tokenization to Solana blockchain.

- Casual Users: Orca has a user-friendly interface with concentrated liquidity pools, Jupiter has the easy-to-use swap aggregator for optimal trading across multiple DEXs.

These dApps show Solana’s ability to facilitate various DeFi activities from trading and staking to liquidity solutions and real-world assets.

Conclusion

The Solana ecosystem is constantly evolving, with new dApps that offer clear benefits for everyday users and developers alike. At Cyber Bee we dive into how these projects work in real-world scenarios, so you can make decisions based on facts and data, not hype.

Whether you’re trading or building, this guide breaks down what top Solana dApps offer. With real-world use cases and tangible benefits, you can find the right tools to enhance your DeFi experience.