Top Blockchain Business Ideas in 2026

Blockchain business projects are moving forward, but there’s still room for new ideas. The core infrastructure is better, and we’re seeing more specialized use cases and higher expectations from investors. Even though the hype has died down, solid blockchain businesses are still being built—and funded—when the tech clearly solves a real problem.

But many projects still fail for the same reasons: using blockchain when a simpler solution would do, or trying to decentralize things that don’t need it. In this article, we look at blockchain business ideas that are grounded in real demand. We’ll also cover key design choices and performance standards based on what’s working in the market today.

Evaluating a Blockchain Business Idea

The core technical premise remains the same: blockchains introduce cost (latency, throughput limits, complexity, regulatory exposure) in exchange for decentralization, verifiability and censorship resistance. That trade-off only makes sense when your product truly depends on coordination between parties that don’t trust each other—and there’s no simpler way to make it work.

When Blockchain Technology Is Justified

| Domain | Required Property |

|---|---|

| DeFi protocols | Trustless financial logic; permissionless capital |

| Tokenized assets (NFTs, RWA) | Verifiable ownership; composability |

| DAO tooling | Transparent coordination; stake-weighted voting |

| Cross-ecosystem middleware | Shared security layer; no centralized control |

Basically, if you don’t need blockchain technology’s special trust and transparency features, it often just adds unnecessary complexity.

Where Traditional Infrastructure Performs Better

| Objective | Suitable Non-Blockchain Alternative |

|---|---|

| Data authenticity | Digital signatures, public key infrastructure |

| Immutable records | Merkle trees, append-only databases, Git-style versioning |

| Shared write access | Signed replicated logs, database ACLs |

| Physical asset tracking | Hardware integrity + audit trails; not on-chain consensus |

Traditional methods outperform blockchain in terms of speed, privacy, and regulatory flexibility in real-world deployments. Particularly during early validation stages or enterprise integrations, control and clarity are crucial.

Deployment & Cost Considerations

Blockchain increases transparency and coordination, but it does not eliminate friction. Several factors need to be considered, such as contract upgradeability, validators or nodes, unpredictable gas costs, and audit complexity. For a proper balance of these overheads, it is necessary to consider the benefits, such as deeper user trust, native liquidity access, or stronger alignment with ecosystem standards.

Token design requires discipline. Every token should have a concrete purpose – whether that’s incentivizing liquidity, enabling access, managing governance or acting as risk collateral. If your token doesn’t serve one of these purposes – or if ETH or USDC can do the same job more efficiently – then your token is being used for speculation not strategy.

Top 10 Blockchain Business Ideas 2026

1. AI-Powered Yield Strategies

Autonomous capital allocation using off-chain AI + on-chain smart contracts.

What It Is

AI-powered vaults use off-chain machine learning models to analyze yield protocols, simulate outcomes, and optimize asset allocation. On-chain contracts execute these decisions securely and transparently—automating what was once a manual or rules-based strategy.

Core Architecture

| Layer | Function |

|---|---|

| Vault Contract | Manages assets, enforces rebalance thresholds |

| AI Agent (off-chain) | Runs LSTM/RL models, generates allocation instructions |

| Automation Layer | Gelato / Chainlink triggers vault actions |

| Risk Module | Commit-reveal logic, delta caps, circuit breakers |

| Monitoring | Forta agents detect anomalies |

Who Uses It

- DAO treasuries optimizing idle assets

- Family offices seeking automated yield

- DeFi-native protocols offering vault-as-a-service

Monetization Models

| Revenue Stream | Notes |

|---|---|

| Performance Fee | 10–20% of yield generated |

| Protocol Fee | 0.5–2% AUM |

| SDK Licensing | $50K–$200K/year for white-label deployments |

Common Pitfalls

| Issue | Impact |

|---|---|

| On-chain AI Logic | Gas-heavy, inflexible, not real-time |

| Overbuilt MVPs | Slow validation cycles, unclear UX |

| Lack of Guardrails | Leads to high-risk rebalancing or capital loss |

Case Study: Sommelier Finance

Sommelier exemplifies this model. It uses Cosmos validators to approve AI-generated rebalancing signals, executed on Ethereum vaults. The protocol’s Trend Vault delivered 22% APY in 2025, scaling from $40M to $320M TVL within 18 months. Revenue is generated via vault fees and reinvested in SOMM token buybacks, aligning growth with token holder incentives.

| Metric | Value (2025) |

|---|---|

| TVL Growth | $40M → $320M |

| Flagship Product | Trend Vault (22% APY) |

| Monthly Revenue | ~$2M |

| Monetization | Performance + protocol fees + token buybacks |

2. On-chain Reputation Scoring Engines

Wallet-based trust systems enabling credit, governance, and Sybil protection.

What It Is

Reputation engines analyze on-chain behavior—like lending, DAO activity, and asset history—combined with decentralized identifiers (DIDs) and zero-knowledge credentials. The result is a wallet-level trust score used across DeFi applications for risk assessment, governance rights, and access control.

Who Uses It

| Segment | Use Case |

|---|---|

| DeFi Lenders | Enable undercollateralized loans |

| DAOs | Vote weighting based on participation history |

| RWA Platforms | Assess counterparty risk |

| Onboarding dApps | Sybil-resistant airdrops and whitelisting |

| Compliance Integrators | Identity-aware DeFi access for institutions |

Architecture Overview

| Layer | Function |

|---|---|

| Data Indexer | Aggregates wallet activity (DeFi use, DAO votes, SBTs) |

| Scoring Engine | ML models compute trust scores (lending risk, governance behavior) |

| Privacy Layer | ZK-proofs enable credential verification without full data exposure |

Adoption Metrics

| Metric | Value (2025) |

|---|---|

| Total Value Secured | $12B in undercollateralized loans |

| Active Wallets | 8M+ with DIDs or SBTs |

| DAO Adoption | 60% of major DAOs use rep-weighted voting |

| Use Cases | Airdrops, DAO voting, DeFi credit |

Monetization Models

| Stream | Description |

|---|---|

| API Access (RaaS) | Tiered pricing ($50–$500/month per app) |

| Enterprise Packages | Reg-compliant scoring ($100K+ annually) |

| Credential Minting | $1–$5 per issued badge (e.g., “Trusted Curator”) |

Common Pitfalls

| Issue | Impact |

|---|---|

| Score Opacity | Hard to compare scores across systems |

| Reputation Farming | Sybil attacks through high-volume fake activity |

| ZK-Proof Cost | High computation slows scaling |

Solutions in 2025

| Solution | Description |

|---|---|

| RepScore Benchmarks | Unified scoring standards for ecosystem interoperability |

| ML Anomaly Detection | Filters for artificial activity and time-weighted scores |

| Optimized ZK Circuits | Use of Risc0, Herodotus for lower-cost privacy |

Case Study: Nomis Protocol

Nomis is a reputation protocol offering real-time credit scoring for DeFi users based on wallet history, cross-chain activity, and financial behavior. The platform assigns dynamic scores to help lenders, dApps, and DAOs assess counterparty risk and tailor access to financial products.

| Metric | Value (2025) |

|---|---|

| Wallets Scored | 1.2M+ unique addresses |

| Supported Chains | Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum |

| Revenue Model | Tiered API access + integration fees |

Use Cases & Integrations

| Partner dApp | Utility |

|---|---|

| Morpho Lending | Credit-based borrowing limits |

| Galxe | Sybil protection for community rewards |

| Liquis DAO | Score-gated governance participation |

Key Features

- Real-Time Scoring Engine: Evaluates loan history, TVL interactions, wallet age, and protocol usage.

- API & SDK Access: Enables developers to plug Nomis scores into lending, governance, and airdrop mechanisms.

- Custom Score Logic: Projects can request score modules tailored to their risk or reputation criteria.

Strategic Insight

Nomis demonstrates how wallet-level scoring can bridge user identity, risk analysis, and eligibility—without sacrificing privacy. Its modular API approach and cross-chain reach make it a foundational layer for identity-aware dApps. For founders exploring on-chain identity or credit products, Nomis offers a replicable model with monetizable infrastructure and growing institutional demand.

3. Real-World Asset (RWA) Tokenization Platforms

Bridging real-world finance and DeFi via tokenized asset flows.

What It Is

RWA tokenization platforms convert real-world assets—like real estate, invoices, and private credit—into blockchain-native tokens (ERC-20s, NFTs). These assets can then be traded, staked, or used as collateral across DeFi protocols. By leveraging blockchain’s immutable ledger and smart contracts, RWA platforms unlock liquidity, transparency, and automation for previously opaque markets.

Key User Segments

| Segment | Use Case |

|---|---|

| Institutional Managers | Tokenize portfolios for liquidity or refinancing |

| Real Estate Syndicates | Enable fractional ownership and rental payouts |

| SME Lenders | Turn invoices into tradeable collateral |

| RWA DAOs | Deploy capital into tokenized yield assets |

| TradFi–DeFi Bridges | Provide compliant DeFi access to regulated entities |

Revenue Streams

| Model | Details |

|---|---|

| Issuance Fees | 1–3% onboarding cost per tokenized asset |

| Lending Spread | Margin from DeFi-based lending pools |

| Compliance Fees | KYC, legal wrappers, custody & audit services |

Architecture & Tech Stack

| Layer | Role |

|---|---|

| Token Standards | ERC-3643, ERC-4626, or NFTs with asset metadata |

| Legal Wrappers | SPVs and custodial trusts for enforceability |

| Oracles | Price feeds and compliance attestations |

| Frontend Layer | Investor dashboards, KYC workflows, asset tracking |

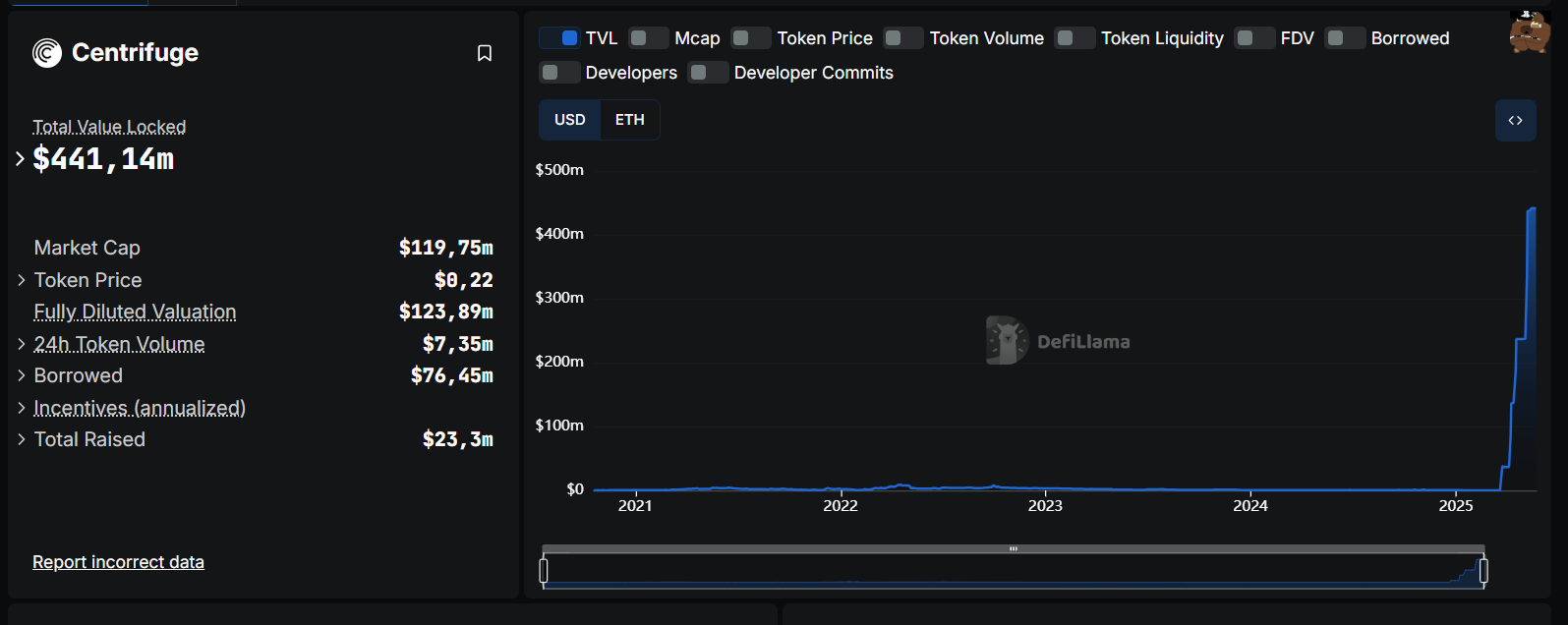

Case Study: Centrifuge

Source: DefiLlama

A Polkadot-native protocol, Centrifuge has tokenized $661M+ in private credit, integrating with MakerDAO and BlockTower Credit for a $220M institutional RWA fund.

| Metric | Value (2025) |

|---|---|

| RWAs Tokenized | $661M+ |

| Institutional Partnerships | MakerDAO, BlockTower Credit |

| Revenue Model | Origination + servicing fees |

Common Pitfalls

| Risk | Impact |

|---|---|

| Regulatory Uncertainty | Legal non-compliance can block asset flows |

| Oracle Inaccuracy | Mispricing may undermine asset trustworthiness |

| Low Liquidity | Difficult secondary trading post-tokenization |

Strategic Insight

With over $50B in tokenized RWAs by 2025, the sector is maturing fast. Founders should prioritize regulatory alignment, reliable pricing oracles, and secondary liquidity channels to ensure adoption and scale. Embedded compliance and standardized metadata will define the next wave of cross-chain, institutional-grade asset protocols.

4. Restaking-as-a-Service (RaaS)

Maximizing capital efficiency by extending the utility of staked assets.

What It Is

Restaking platforms enable users to re-use their staked ETH or Liquid Staking Tokens (LSTs) to secure additional services—like oracles, bridges, and data availability layers—while earning extra yield. Instead of sitting idle, staked assets become multi-purpose collateral for emerging protocol infrastructure.

Who It’s For

| User Type | Role in the Ecosystem |

|---|---|

| LST Holders | Delegate to restaking platforms for extra APY |

| Validators | Run infrastructure to support AVSs |

| AVS Developers | Tap into pooled security without bootstrapping a validator set |

How Platforms Make Money

| Revenue Stream | Description |

|---|---|

| Delegation Fees | Cut from restaking rewards distributed to users |

| AVS Integration Fees | Paid by protocols that tap into pooled validators |

| Infrastructure Services | Hosting, monitoring, and slashing protection for AVSs |

Core Tech Stack

| Component | Function |

|---|---|

| Staking Interface | UX for LST holders to delegate restaking rights |

| AVS Routing Layer | Maps capital to specific protocol use cases |

| Slashing Controls | Mitigation tools to avoid user loss on AVS failure |

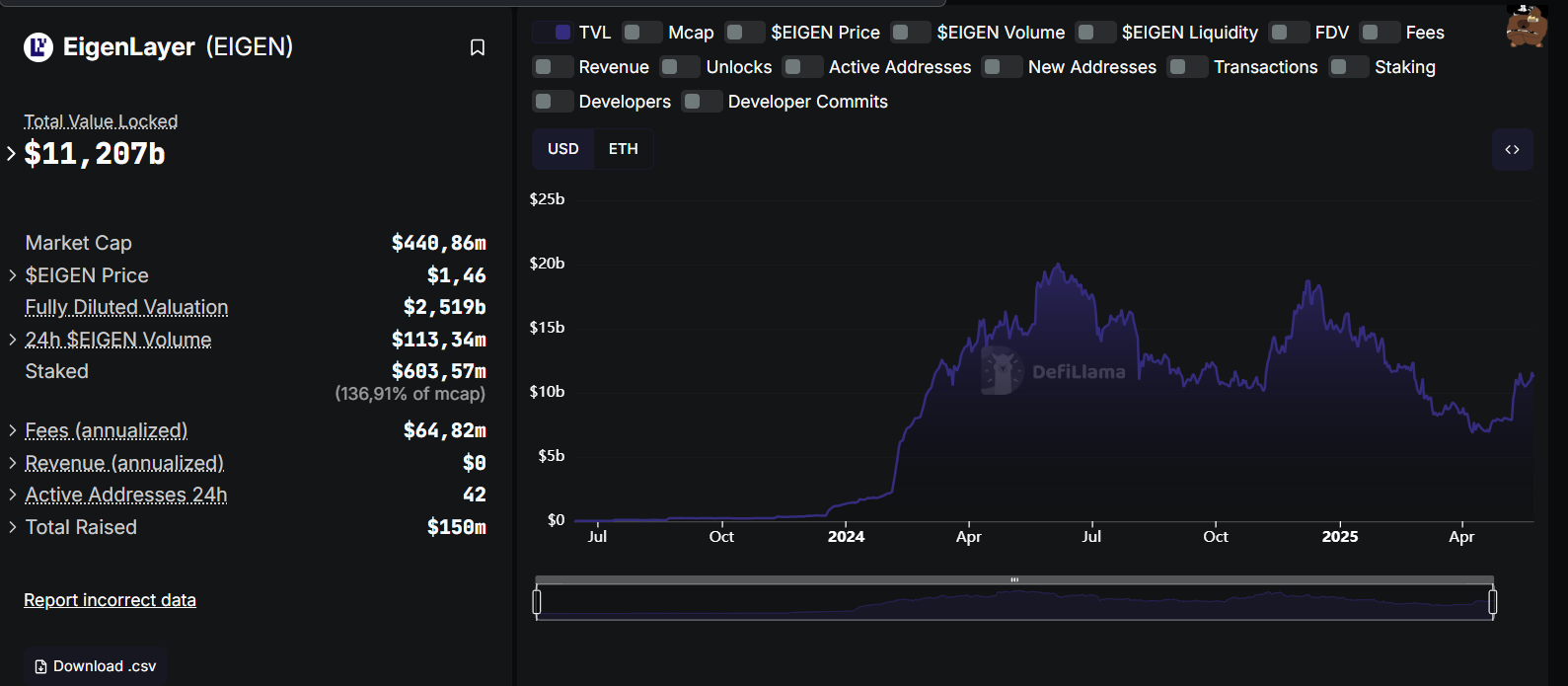

Case Study: EigenLayer

Source: DefiLlama

Launched in 2023, EigenLayer introduced the concept of restaking as middleware for Ethereum. By 2025, it surpassed $90M in TVL and supports services like Beacon Chain data validation and oracle uptime.

| Metric | Value |

|---|---|

| Launch Year | 2023 |

| Total Value Restaked | $90M+ |

| Key Use Cases | DA layer monitoring, oracles, AVS testing |

Operational Model

- Restaking Protocol Layer: Manages delegation, slashing, and validator registration

- Beacon Data Layer: Tracks validator behavior and restaking outcomes

- Dashboards: Display user deposits, AVS uptime, and yield metrics in real time

Challenges & Considerations

| Risk | Implication |

|---|---|

| Slashing Events | Losses if AVS misbehaves or fails |

| Idle Capital | Unused capital if AVS demand is low |

| Overengineering | High upfront build cost before protocol traction |

Outlook

Restaking expands the economic utility of staked capital and lowers the barrier for new protocols needing security. But founders should avoid overbuilding before AVS partners are secured. Focus on safe routing, validator coordination, and clear user incentives to build sustainable RaaS offerings.

5. B2B Tools for Web3 Startups (SaaS)

Infrastructure and automation services powering the backend of modern crypto projects.

What it is

SaaS platforms offering APIs, dashboards, and compliance tools for Web3 startups. They streamline operations like tokenomics modeling, payroll, and compliance without custodial control.

Target Users

Web3 founders, DAO operators, crypto HR teams, launchpad platforms, and treasury managers.

Business Model

| Stream | Description |

|---|---|

| SaaS Subscriptions | Tiered monthly/annual plans based on usage/API calls |

| Transaction Fees | Per-action fee (e.g., token vesting, payroll) |

| Custom Integrations | One-time setup or retainer deals for enterprise clients |

Technology & Architecture

| Component | Purpose |

|---|---|

| API Layer | Exposes core services (vesting, token allocation) |

| Dashboard Interface | Admin panel for non-technical users |

| Blockchain Integrations | Connects to supported networks (EVMs, Solana) |

| Compliance Module | Handles KYC/AML, payroll, and tax logic |

Monetization:

Token vesting, lockups, and fiat offramps for streamlined operations.

Common Pitfalls

| Problem | Impact |

|---|---|

| Targeting “web3 hype” teams | Low retention once funding dries up |

| Over-customization | Difficult to scale with bespoke logic |

| UX too technical | Slows adoption among non-developers |

Startups need operational infrastructure, not just community tools. Focus on high-friction pain points like token vesting and compliance.

Case Study: Toku — Token Compensation and Global Payroll Compliance

| Users | 200+ Web3 companies (including Arbitrum, Lens, Safe) |

|---|---|

| Use Cases | Token payroll, equity tax compliance, benefits administration |

| Model | Token-based HR & payroll infrastructure |

Overview

Toku provides full-stack token compensation and global employment services for crypto-native teams. Its platform enables compliant token vesting, tax withholding, and salary payments in both fiat and crypto across 100+ jurisdictions.

Growth & Adoption

Toku has emerged as the leading HR and payroll provider for DAOs and tokenized startups, powering compensation for projects like Arbitrum and Lens Protocol. By abstracting global compliance, it allows teams to scale without jurisdictional friction.

Key Architecture

| Component | Function |

|---|---|

| Token Vesting Engine | Automates on-chain equity disbursement with tax logic |

| Global Payroll Layer | Enables fiat and crypto salary payments with local compliance |

| HRIS Integration API | Syncs with internal ops tools for benefits and reporting |

Strategic Insight

Toku solves a foundational problem for blockchain startups: how to hire, pay, and retain talent legally while working with digital assets. Its success lies in bridging crypto-native compensation models with real-world tax and labor compliance—making it a model for founders building B2B SaaS tools in regulated segments of Web3.

6. Decentralized Gambling Protocols

Transparent, trustless betting systems powered by blockchain smart contracts.

What it is

These platforms provide on-chain gambling experiences (e.g., lotteries, prediction markets, casino games) using smart contracts for fairness and transparency. Verifiable decentralized RNG systems remove the need for intermediaries.

Target Users

dApp developers, crypto gambling startups, Web3 gaming projects with betting features, and prediction market builders.

Business Model

| Model | Description |

|---|---|

| Transaction Fees | % cut from bets, ticket sales, or game participation |

| Token Incentives | Native token staking, rewards, or governance dividends |

| White-label Licensing | Branded protocol deployment for external operators |

Technology & Architecture

| Component | Purpose |

|---|---|

| Smart Contract Logic | Handles game rules, payouts, and bet resolution |

| Verifiable RNG System | Chainlink VRF or custom ZK-based randomness |

| Player Interface | Frontend for placing bets and claiming rewards |

| Crypto Payments | Enables wallet deposits, withdrawals, and prize pooling |

Case Study: TryRaffle — Decentralized Lottery Platform on BASE

| Users | Early-stage adoption across BASE network communities |

|---|---|

| Use Cases | Blockchain-based lotteries, prediction games, referral contests |

| Model | Smart contract-based game engine with automated payouts |

Overview

TryRaffle is a decentralized lottery platform built on the BASE network. It leverages Chainlink VRF for verifiable randomness and supports automated reward distribution via smart contracts. The platform includes Telegram bot integration for real-time notifications and offers referral-based participation incentives.

Growth & Adoption

TryRaffle has deployed three custom lottery games with fully on-chain logic and built-in referral mechanics. Its lightweight backend allows operators to configure games and distribute prizes without intermediaries.

Key Architecture

| Component | Function |

|---|---|

| Lottery Smart Contracts | Manage game logic, ticket sales, and winner selection |

| Chainlink VRF | Ensures fair and verifiable randomness for draws |

| Telegram Bot Integration | Delivers live game updates and prize alerts to participants |

| Referral Engine | Incentivizes organic user growth via on-chain referrals |

Strategic Insight

TryRaffle exemplifies how small-footprint gambling protocols can operate with minimal infrastructure and verifiable fairness. For founders entering this space, focusing on transparent randomness, mobile-first UX, and simplified payout flows is critical to building trust and traction in a highly regulated segment.

7. DAO as a Service

No-code infrastructure for launching and managing decentralized organizations

What It Is

DAO-as-a-Service platforms enable teams to create and manage DAOs without smart contract development. These tools provide interfaces for proposal management, treasury control, voting logic, and member governance—lowering the barrier to decentralized coordination.

Target Users

Web3 startups, investment collectives, online communities, and projects implementing decentralized governance.

Monetization Models

| Model | Description |

|---|---|

| Subscription (SaaS) | Recurring fees for platform access |

| Transaction Fees | Charges per proposal, vote, or action |

| Enterprise Integration | Custom features, templates, and API access |

MVP Requirements

- Visual DAO builder (no-code or low-code)

- Governance engine (proposals, voting)

- Treasury tools (multisig, token gating)

- Member management dashboard (DAO CRM)

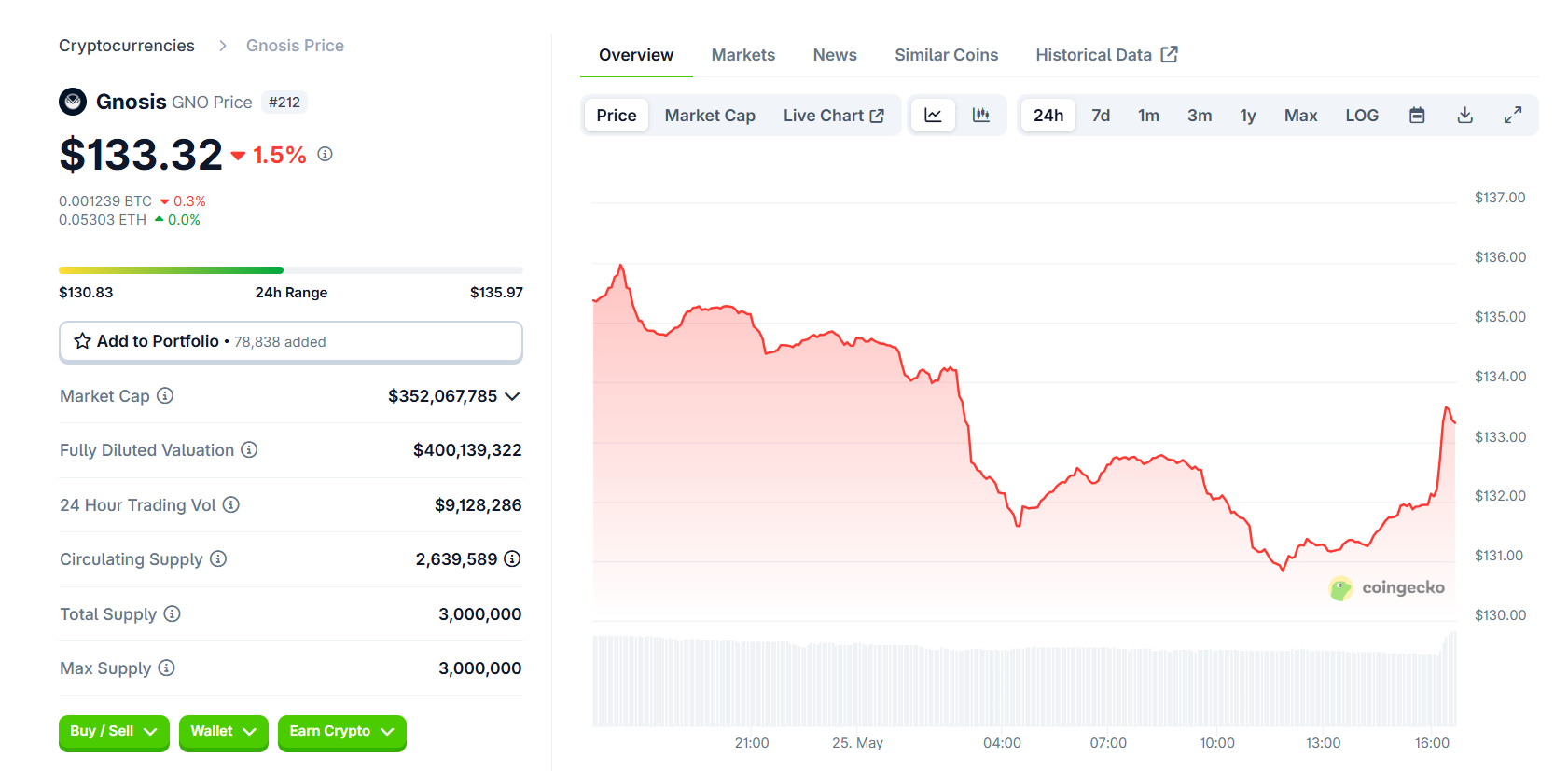

Case Study: Gnosis Zodiac

Source: CoinGecko

| Users | 2,000+ DAOs using Zodiac-enabled tooling across Ethereum and L2s (2025) |

|---|---|

| Use Cases | Modular DAO governance, multisig automation, off-chain to on-chain voting |

| Model | Governance plugins + open standards for Safe-based DAOs |

Overview

Zodiac is a governance framework developed by Gnosis Guild, designed to extend the functionality of Safe (formerly Gnosis Safe). It enables flexible DAO structures through a collection of smart contract modules—allowing decentralized organizations to implement custom voting mechanisms, roles, and execution flows without writing code.

Zodiac introduces composable standards like modules, guards, and avatars, which together serve as building blocks for scalable DAO operations. It supports off-chain voting via Snapshot and can automate execution via Zodiac plugins.

Growth & Adoption

By 2025, Gnosis Zodiac powers governance for prominent DAOs and DAO tooling platforms, including SafeDAO, Shapeshift DAO, and several ecosystem funds. The growing demand for modular DAO setups has pushed Zodiac adoption across L2 ecosystems (Arbitrum, Optimism, Gnosis Chain) with direct integration into DAO platforms and Safe apps.

Key Features

| Component | Function |

|---|---|

| Zodiac Modules | Extend Safe with programmable governance (e.g., timelocks, quorum rules) |

| Snapshot Executor | Bridges off-chain voting with on-chain execution |

| Roles & Guards | Enforce proposal rules, thresholds, or veto rights |

| Avatar Framework | Abstract control layer for DAOs, enabling upgradeable governance structures |

Strategic Insight

Zodiac demonstrates that DAO infrastructure doesn’t require full-stack rewrites. Instead, by extending a widely adopted standard like Safe, it introduces composability, flexibility, and security at scale—helping DAOs transition from experimental collectives into sustainable governance entities.

This modular approach is particularly relevant as projects seek to align multisig security, treasury automation, and progressive decentralization—with minimal engineering lift.

8. ZK-powered Privacy Layers for Web3 Apps

Modular infrastructure for private transactions and verifiable identity in dApps

What It Is

Zero-knowledge (ZK) privacy layers allow Web3 apps to integrate user privacy features—such as encrypted transactions, private voting, or identity verification—without compromising decentralization. These components are typically SDKs or plug-ins that developers add to existing smart contracts or frontends.

Target Users

DeFi protocols, NFT platforms, gaming dApps, and any application requiring private identity or transaction logic.

Monetization Models

| Model | Description |

|---|---|

| SDK Licensing | Integration fees for adding ZK modules |

| Verification Fees | Per-check fee for KYC or identity proof |

| Subscription (SaaS) | Tiered plans based on usage volume or features |

- SDK for ZK-KYC and transaction masking

- On-chain vMVP Requirementserifiers for identity or asset logic

- ZK circuit templates (e.g., Semaphore, Noir)

- Developer docs and test harnesses

Case Study: zkMe

| Focus | Zero-knowledge KYC and identity verification |

|---|---|

| Main Use Case | Private whitelist access, token-gated KYC, DID integration |

| Clients | LayerZero, Galxe, Gitcoin, EigenLayer |

| Monetization | Verification and partner integration fees |

Overview

zkMe provides modular identity infrastructure using ZKPs to prove user status (e.g., KYC-verified, age-compliant) without revealing personal data. Built for seamless integration, zkMe allows dApps to run compliance checks directly in the wallet or frontend, keeping credentials off-chain and user-controlled.

Growth & Adoption

As of 2025, zkMe has processed hundreds of thousands of verifications and integrated into top Web3 campaigns like zkSync airdrops and EigenLayer whitelist checks. The platform also supports GDPR compliance and works with institutional-grade identity providers.

Key Components

| Module | Function |

|---|---|

| zkKYC Engine | Zero-knowledge credential generation and verification |

| MeID Wallet | Self-sovereign, encrypted credential storage |

| Partner SDK | Lightweight SDK for frontend and contract integration |

Strategic Insight

As regulation around data privacy tightens, ZK-powered identity will become a non-negotiable feature for dApps seeking to scale globally. Platforms like zkMe show how privacy and compliance can co-exist—enabling secure onboarding without surveillance.

9. Decentralized Stablecoin Collateral Engines

Alternative models for stablecoin issuance using on-chain, non-custodial collateral

What It Is

These protocols issue stablecoins backed by crypto-native assets—such as ETH, BTC, or liquid staking tokens (LSTs)—instead of centralized fiat reserves like USDC or Tether. Smart contracts manage minting, redemptions, collateral ratios, and liquidation logic. The result is improved decentralization and minimized counterparty risk, though design complexity and price volatility remain key challenges.

Target Users

DeFi lending markets, yield platforms, DAO treasuries, and investors seeking non-custodial stable assets.

Monetization Models

| Model | Description |

|---|---|

| Position Fees | Ongoing fees for borrowing or holding a stablecoin |

| Mint/Redeem Fees | Small charge per minting or redemption transaction |

| Liquidation Revenue | Profits from liquidating under-collateralized positions |

MVP Requirements

- Smart contract logic for mint/redeem

- Dynamic collateral support (e.g., LSTs, synthetic derivatives)

- Oracle integrations for real-time pricing

- Automated liquidation engine

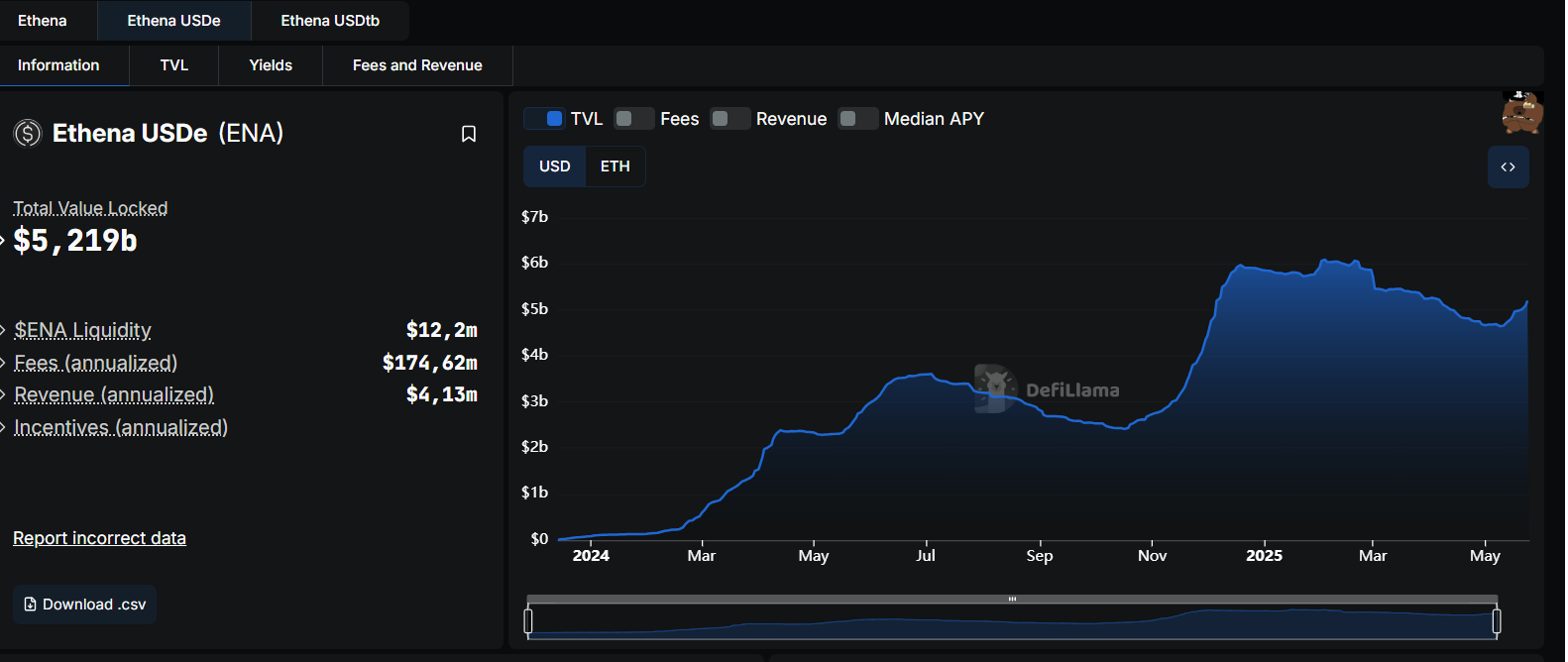

Case Study: Ethena (USDe)

Source: DefiLlama

| Protocol | Ethena (USDe) |

|---|---|

| Collateral Base | Long BTC/ETH + short perp positions (delta-neutral) |

| Stablecoin Type | Synthetic dollar pegged via hedging |

| Launch Timeline | Q1 2024 – raised $14M, $70M TVL within 2 months |

| Yield Strategy | Captures funding rate differentials on perp markets |

Overview

Ethena launched USDe as a synthetic stablecoin built on a delta-neutral model. It maintains its peg not by holding fiat reserves, but by combining spot crypto collateral with short perpetual futures. This unique approach allows the protocol to generate yield while minimizing directional exposure.

Growth & Adoption

In just two months post-launch, USDe amassed over $70M in TVL. It drew attention from both DeFi users and institutional investors due to its passive yield model and reduced reliance on centralized stablecoins.

Monetization

Ethena earns through:

- Mint/redemption fees

- Perpetual funding arbitrage

- Liquidation spreads on undercollateralized positions

Challenges to Monitor

| Risk | Impact |

|---|---|

| Collateral Volatility | Yield and peg may suffer during extreme market swings |

| Strategy Complexity | Requires continuous hedge balancing and exchange liquidity |

| Regulation | Synthetic dollars may trigger increased regulatory scrutiny |

Strategic Insight

Protocols like Ethena are pioneering stablecoin designs with minimal reliance on custodians or fiat. As appetite for decentralized financial primitives grows, delta-neutral or multi-asset-backed models could reshape the future of crypto-native money—especially if they can scale with resilience across market cycles.

10. White-Label Crypto Infrastructure (B2B)

Plug-and-play backend for launching branded crypto products

What It Is

White-label crypto infrastructure allows businesses to offer blockchain services—wallets, custody, KYC, token issuance—without building the backend themselves. Providers offer APIs, SDKs, and branding support to help companies deploy secure, compliant crypto features quickly.

Target Users

| Segment | Use Case |

|---|---|

| Crypto Startups | Launch wallets, tokens, or exchanges fast |

| Fintech Platforms | Add crypto rails or stablecoin accounts |

| Web3 Projects | Enable secure onboarding and compliance layers |

Monetization Models

| Model | Description |

|---|---|

| Subscription (SaaS) | Monthly or annual platform fees |

| Fee-as-a-Service | Per-transaction, per-wallet, or API usage charges |

| White-label Licensing | Custom UI, branding, and technical support packages |

Core MVP Components

| Component | Role |

|---|---|

| Wallet Infrastructure | Secure key storage (MPC, HSM, or custodial) |

| Custody Services | Regulated asset custody and transfer management |

| KYC/AML Compliance | Identity verification integrations via API |

| Token Tools | Token launchpad, vesting, and management modules |

What You Need to Launch an MVP (and Not Fail)

A blockchain MVP is not a finished product. It’s a functional proof that your idea works—and that users want it.

- Start with a Clear Tech StackChoose tools and blockchains that match your use case. Avoid defaulting to “just EVM.” Modular architecture and an integration roadmap matter more than hype.

- Skip the UI—For NowYou don’t need a pretty interface to prove your idea works. Many early blockchain projects validate their concept with command line tools, simple scripts or backend APIs. Focus on getting the core logic right—UX can come later.

- Work With a Lean, Smart TeamYou don’t need a full time team from day one. A part time CTO, a trusted dev partner or a service based team can help you move faster without the overhead. At this stage validation matters more than headcount.

- Build With Funding in MindShape your MVP around what early stage investors and Web3 grant programs actually look for: a sharp use case, simple architecture and signs of real traction. Whether you’re building in DeFi, identity or tokenized assets—make it obvious why this solution is needed right now.

How to Test the Market Before Writing Any Code

You don’t need a product to validate your idea. Great Web3 founders test demand early—before any smart contract is deployed.

Pitch Deck → Feedback Loop

Create a simple deck that explains the problem, solution, and user flow. Make it available to other builders, investors, or DAOs.

Landing Page with Email Collection

Set up a one-pager that speaks to your target audience. Add a clear CTA (“Join the waitlist,” “Get early access”) to measure real interest.

Apply for Grants Without a Product

Web3 grant programs don’t require code. A solid concept, clear roadmap, and problem-solution fit can win early support from protocols and ecosystems.

Use Twitter to Validate Fast

Crypto Twitter is your testbed. Share your idea in public—threads, polls, or concept visuals. Look for engagement, interest, and questions. If people lean in, you’re on the right track.

What Kind of Teams or Founders Succeed in 2025

It’s not about how much you raise—it’s about how fast and focused your team can move in an evolving market.

Lean, Focused Teams Win

The ideal early-stage team:

- 1 founder with domain expertise

- 1 technical builder (smart contracts, backend)

- 1 operator (marketing, comms, product ops)

Avoid bloated org charts. Speed > size.

Web2 Product Background = Advantage

Founders with experience in UX, growth, or SaaS workflows tend to ship faster. They know how to run sprints, track metrics, and iterate—key for early traction.

Fast Learners Beat Deep Experts

Tech evolves weekly. Standards change. L2s shift. Market needs pivot. Teams that stay curious and adapt quickly will outpace those focused only on engineering depth.

Clear Docs & Internal Culture Matter

If you’re raising funds, hiring or scaling governance, clear communication wins. Successful teams write things down, stay aligned and build around a shared roadmap.

Strong culture, simple ops and fast execution are the foundation for long-term survival in crypto

Final Thoughts: Build Smart, Ship Fast, Stay Grounded

The crypto space is crowded with hype but smart founders know that traction beats theory. Focus on core user needs, build an MVP that shows blockchain innovation and test everything before scaling. Whether you’re building in finance, healthcare or DeFi, success comes from clarity, speed and real-world validation.

Need help with your MVP or token model? Let’s talk. 👉 Schedule a 30-minute call